Question 1. Consider the aggregate production function depicted in class lecture to answer this set of questions.

a. The labor market is in equilibrium and the economy is currently producing a level of real GDP we will call Y1. Suppose that the amount of capital in the economy is decreased due to a ferocious hurricane. Given this information and holding everything else c onstant, what do you predict will happen to the following?

i. Real GDP will ________

ii. Labor productivity will _______

iii. Capital productivity will __________

b. The labor market is in equilibrium and the e conomy is currently producing a level of real GDP we will call Y1. Suppose that the amount of technology in the economy increases at the same time that the amount of labor in the economy increases. Given this information and holding everything else constan t, what do you predict will happen to the following?

i. Real GDP will _______ ii. Labor productivity will ______ iii. Capital productivity will ______

Question 2 . Consider the Keynesian short - run model discussed in class for this question. You are given the following information:

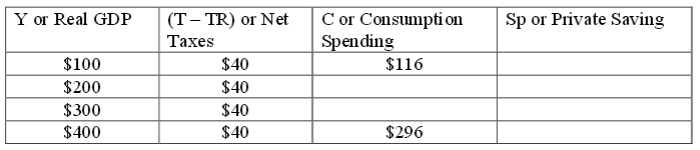

C = a + b[Y – (T – TR)] where C is consumption spending, Y is real GDP, (T – TR) is net taxes, "a" is autonomous consumption and "b" is the marginal propensity to consume (T – TR) = net taxes = Taxes – Transfers = $40 G = government spending = $50 I = investment spending = $20 (X – IM) = net foreign sector spending = Exports – Imports = $10 You are also given the following data

a. Given the above information, find the value of autonomous consumption, the value of the marginal propensity to consume, and the equation for the consumption function as a function of disposable income, [Y – (Y – TR)]. Determine whether this economy is operating with a government deficit, a balanced budget, or a government surplus.

i. autonomous consumption is equal to ______

ii. the marginal propensity to consume is equal to _______

iii. the consumption function can be written as ________

iv. this economy is oper ating with a _______

b. Using the above information find the equilibrium level of real GDP for this economy. Show your work.

c. Fill in all the missing values in the table:

Question 3. Consider the market for loanable funds as discussed in class to answer this set of questions.

a. The loanable funds market is initially in equilibrium and the government is operating with a balanced budget. The government decides to increase its government spending while maintaining a constant level of taxes. Holding everything else constant, what do you predict will happen to the following?

i. The equilibrium interest rate will ______

ii. The equilibrium level of private investmen t spending will _______

iii. The equilibrium level of private saving will _______

iv. The equilibrium level of consumption spending will _______

b. The loanable funds market is initially in equilibrium and the gover nment is operating with a budget surplus. Suppose that the government reduces its budget surplus (it is still a surplus, just smaller) at the same time that there is an increase in the demand for private investment spending at every interest rate. Holding everything else constant, what do you predict will happen to the following?

i. The equilibrium interest rate will _______

ii. The equilibrium level of private investment spending will ______

iii. The equilibrium level of private saving will _______

iv. The equilibrium level of consumption spending will _______