Question 1: Foreign Exchange Market Equilibrium.

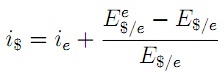

We say that the foreign exchange market is in equilibrium when deposits of all currencies o�er the same expected rate of return (when returns are denominated in the same currency). Formally,

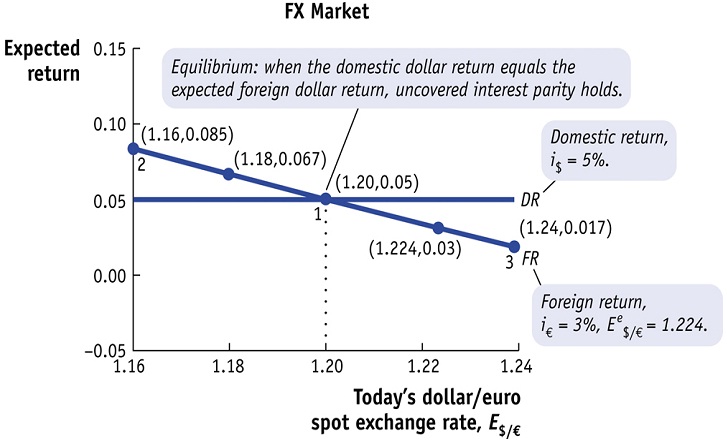

a) Explain why in points 2 and 3 in Figure below the foreign exchange market is not in equilibrium. Do not forget to use a graph to support your answer and describe how the equilibrium can be restored.

b) Now suppose the foreign exchange market is in equilibrium (that is, point 1 in Figure below). Explain what would happen to the US/euro nominal exchange rate if the interest rate in Europe falls. Do not forget to use a graph to support your answer.

Figure: Foreign Exchange Market Equilibrium

Question 2: Chinese Current Account Surplus vs U.S. Current Account De�cit.

Recently, there has been substantial pressure on China from the U.S. government to allow the value of the yuan (i.e. the Chinese currency) to appreciate relative to the U.S. dollar. Why might the U.S. government want this change in the value of the yuan? How would such a change a�ect the relative price of Chinese goods versus U.S. goods? How would it a�ect the value of U.S. liabilities owned by Chinese residents?

Question 3: The Exchange Rate and International Trade.

In the past few decades, �rms from industrial economies have installed production plants in developing countries. This strategy allowed them to move production from expensive locations to cheaper ones (a phenomenon called outsourcing). If the Indian Rupee appreciates against the Canadian dollar, what would happen to outsourcing in India by Canadian companies? Describe.

Question 4: Money Supply Shocks and the Nominal Exchange Rate.

Use the money and foreign exchange markets diagrams to answer the following questions about the relationship between the British pound (£) and the U.S. dollar ($). Let the exchange rate be de�ned as U.S. dollars per British pound, E = $/£. We want to consider how a change in the U.S. money supply a�ects interest rates and exchange rates. On all graphs, label the initial equilibrium point A.

a) Illustrate and explain how a temporary decrease in the U.S. money supply a�ects the money and foreign exchange markets. Label your short-run equilibrium point B and your long-run and equilibrium point C.

b) Using your diagram from (a), state how each of the following variables changes in the short run (increase/decrease/no change): U.S. interest rate, British interest rate, E$/£, Ee$/£, and U.S. and British price levels.

c) Using your diagram from (a), state how each of the following variables changes in the long run (increase/decrease/no change relative to their initial values at point A): U.S. interest rate, British interest rate, E$/£, Ee$/£ and U.S. and British price levels.

Question 5: Money Market and Foreign Exchange Market.

Use the foreign exchange market and money market diagrams to answer the following questions. This question considers the relationship between Swedish kronor (SK) and Danish krone (DK). Let the exchange rate be de�ned as Swedish kronor per Danish krone, ESK/DK. On all graphs, label the initial equilibrium point A. Suppose that there is an economic boom in Sweden, leading to an increase in real money demand in that country.

a) Assume this change in real money demand is temporary. Using the foreign exchange market and money market diagrams, illustrate and explain how this change a�ects the money and foreign exchange markets. Label your short-run equilibrium point B and your long-run equilibrium point C.

b) Now assume this change in real money demand is permanent. Using a new diagram, illustrate and explain how this change a�ects the money and foreign exchange markets. Label your short-run equilibrium point B and your long-run equilibrium point C.

c) Illustrate how each of the following variables changes over time in response to a permanent increase in real money demand: nominal money supply MS, price level PS, real money supply MS = PS, Swedish interest rate iSK, and the exchange rate ESK/DK. Hint: See Figure 15-13 in the textbook to get an idea of how to answer this question.

Question 6: PPP and the LOOP

Suppose that two countries, Brazil and Mexico, produce bananas. Brazil uses the real, Mexico uses the peso. In Mexico, bananas sell for 10 pesos per pound of bananas. The exchange rate is 0.5 reals per peso, Ereals/pesos = 0:5. The peso-dollar exchange rate is Epesos/$ = 10.

a) If LOOP holds, what is the price of bananas in Brazil? What is the price in the United States?

b) Suppose the price of bananas in Brazil is 5.5 reals per pound. At the same time, the price of bananas in the United States is $1.00 per pound. Based on this information, where does LOOP hold?

c) How will banana traders respond to the previous situation? In which markets will traders buy bananas? Where will they sell them? What will happen to the prices of bananas in Mexico, Brazil, and the United States?

Question 7: Fundamental Equation to the Exchange Rate (General Model).

Using the fundamental equations from the general monetary approach, describe how each of the following will a�ect the home and foreign price level, real money balances, and the exchange rate, EH/F . Also, state whether the home currency appreciates or depreciates for each.

a) A permanent increase in home money supply.

b) A permanent increase in the foreign money supply.

c) An increase in home real income.

Question 8: Answer True or False. Briefly explain your answer. Support your answer with a graph if needed.

a) From the PPP theory we can conclude that a country with higher inflation (relative to its foreign partners) should have an appreciating currency.

b) All else equal, a rise in dollar interest rates causes the dollar to appreciate against the euro while a rise in euro interest rates causes the dollar to depreciate against the euro. Today's exchange rate is also altered by changes in its expected future level. If there is a decrease in the expected future level of the dollar/euro rate (Ee$/e), for example, then at unchanged interest rates, today's dollar/euro exchange rate will depreciate.