A particular operation at a manufacturing company costs $100,000 per year in labor costs. A proposal is made to automate this operation with a robot. The cost of the robot, the controller, and ancillary systems is $200,000 installed. It has a 10-year life and no market value at the end of the ten years. The robot will save all of the $100,000 annual labor costs but will require $64,000 per year in maintenance and support. It will be depreciated over the 10-year life using Straight Line (SL) depreciation. The company has an effective income tax rate of 40% and must earn 8% after taxes on projects to consider them viable.

(a) Use the Internal Rate of Return (IRR) method to determine if the robot acquisition is justifiable. The information below will help (a lot)

EOY = End Of Year

TI = Taxable Income

BTCF = Before Tax Cash Flow

T = Tax

d = Depreciation

ATCF = After Tax Cash Flow

Fill in the blanks in the cash flow table for years 1 through 10 – the ATCF will serve as a check.

|

EOY

|

BTCF ($)

|

d ($)

|

TI ($)

|

T(40%) ($)

|

ATCF ($)

|

|

0

|

-200,000

|

N/A

|

N/A

|

N/A

|

-200,000

|

|

1 - 10

|

36,000

|

|

|

|

29,600

|

Note: You only need to show the cash flow once because all of the cash flows for years 1 through 10 are the same as year 1 since the depreciation, d, is straight line.

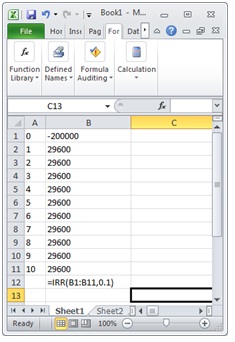

IRR is found where the Resent Worth (PW) = 0: PW =0 = -$200,000 + $29,600(P/A,i’,10)

Look at this very useful tiny ExcelThere is no reason not to use this, it is too easy!

(b) Use MACRS with a seven-year recovery period and determine the new IRR

Here is the partially completed table. Fill in the missing blanks. I filled in a few like a Sudoku to help, but don’t work it like a Sudoku; go methodically left to right!

|

EOY

|

BTCF ($)

|

d Factor

|

d ($)

|

TI ($)

|

T(40%) ($)

|

ATCF ($)

|

|

0

|

-200,000

|

N/A

|

N/A

|

N/A

|

N/A

|

-200,000

|

|

1

|

36,000

|

0.1429

|

|

|

|

|

|

2

|

36,000

|

|

|

|

5192

|

|

|

3

|

36,000

|

|

|

|

|

35,592

|

|

4

|

36,000

|

|

|

|

|

|

|

5

|

36,000

|

|

17,860

|

|

|

|

|

6

|

36,000

|

|

|

|

-7264

|

|

|

7

|

36,000

|

|

|

18,140

|

|

|

|

8

|

36,000

|

0.0446

|

|

|

|

|

|

9

|

36,000

|

N/A

|

N/A

|

|

|

21,600

|

|

10

|

36,000

|

N/A

|

N/A

|

|

-14,400

|

|

|

|

|

|

|

|

PW (8%)

|

$6,226.76

|

|

|

|

|

|

|

IRR

|

|

If your IRR in part (b) is NOT greater than 8%, please give me a detailed explanation as to why this makes sense to you.

Why is the IRR in part (b) larger than in part (a)? (If you happened to get smaller, then please re-work them.)