Question 1:

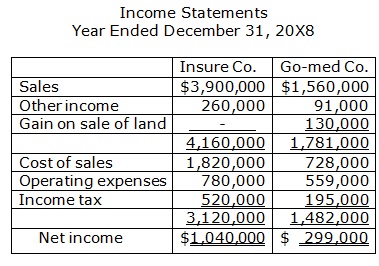

Insure acquired 40% of the common shares of Go-med in 20X2 for $1,072,500.

For 20X8, Insure amortized its acquisition differential as shown:

Buildings $ 11,700

Long-term liabilities (16,250)

Goodwill impairment loss 16,900

$ 12,350

Throughout 20X8, Go-med paid royalties of $162,500 to Insure that Insure comprised in its other income.

Throughout 20X8, Go-med sold land to a third party. It had acquired the land 3 years ago from Insure. At that time, Insure had recorded a profit on the sale of $29,250.

Throughout 20X8, Go-med declared and paid dividends of $104,000.

Both Insure and Go-med pay taxes at an average rate of 40%.

Required:

Suppose that Go-med is a joint venture owned by Insure and four other ventures, that the acquisition differentials are valid, and that it has not yet adopted IFRS 11: Joint Arrangements. Make a 20X8 consolidated income statement for Insure by using proportionate consolidation.

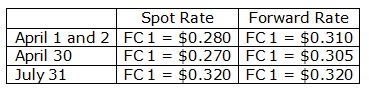

Question 2: On April 1 of the current year, Econ Ltd. ordered maps from a foreign supplier for 500,000 units of foreign currency (FC). On April 2, Econ entered a forward contract as a cash flow hedge to get 500,000 FC on July 31 for $0.31. On July 31, the maps arrived and Econ paid the supplier in full and settled the forward contract. Econ has an April 30 year-end.

Required:

a) Make dated journal entries to record the transactions shown above.

b) Suppose that Econ didn’t enter into a forward contract. Make dated journal entries to record the transactions above.

c) Suppose that Econ had entered into a forward contract that was designated a fair value hedge. Make dated journal entries to record the transactions above.