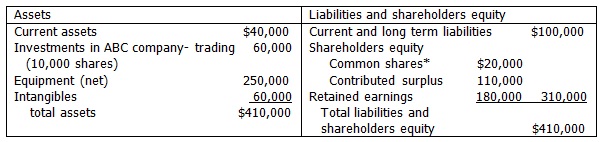

Problem: Guo limited provides you with the following condensed balance sheet information.

* 10,000 shares issued and outstanding

Instructions:

For each transaction below, indicate the dollar impact (if any) on the following five items: (1) total assets, (2) common shares, (3) contributed surplus, (4) retained earnings, and (5) shareholders’ equity. (each situation is independent.)

(A) The company declares and pays a $0.50 per share dividend.

(B) The company declares and issues a 10% stock dividend when the share’s market price is $12 per share.

(C) The company declares and issues a 40% stock dividend when the share’s market price is $17 per share.

(D) The company declares and distributes a property dividend. The company gives one share of ABC shares for every two shares of company shares held. ABC is selling for $12 per share on the date the property dividend is declared.

(E) The company declares a 3-for-1 stock split and issues new shares.