Assignment:

Multiple Choices:

1 Under a fractional-reserve banking system (the required reserve ratio is less than 100%). banks

A. do not accept deposits.

B. generally lend out a majority of the funds deposited.

C. cause the money supply to fall by making loans.

D. All of the above are correct.

2 Suppose a bank desires to hold no excess reserves. The required reserve ratio is 15% and the bank receives a deposit of $600.

A. The bank has to hold $600 as required reserves.

B. The bank can make $600 loans.

C. The required reserves increase by $90 and the bank can loan out $510.

D. The required reserves increase by $510 and the bank can loan out $90.

3 On a bank's balance sheet, which are part of the bank's assets?

A. Reserves.

B. Deposits made by its customers.

C. Loans the bank makes.

D. Bonds the bank purchases.

E. A, C and D.

2. (This is NOT a multiple choice.) Sam has saved $30 per week to buy a new Blu-Ray player. He compares two different models: a Panaview that is priced at $130 and a Zony model that is priced at $140. Sam decides to purchase the Zony Blu-Ray player for $140.

Identify the function of money in each of the following parts of the story.

a. Sam can easily determine that the Panaview model has a lower price than the Zony model.

b. Sam saved $30 per week.

c. Sam pays $140 for the Blu-Ray player.

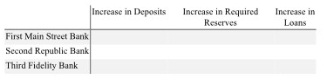

3. Suppose First Main Street Bank, Second Republic Bank, and Third Fidelity Bank all have zero excess reserves. The required reserve ratio is 20%. The Federal Reserve adds $5000 to reserves at First Main Street Bank. Now, suppose First Main Street Bank loans out all of its new excess reserves to Neha, who immediately uses the funds to write a check to Paul. Paul deposits the funds into his checking account at Second Republic Bank. Then Second Republic Bank holds required reserves against new deposits and lends out the rest to Sam, who writes a check to Teresa, who deposits the money into her checking account at Third Fidelity Bank. Third Fidelity holds required reserves and lends out all it could to Beth. Fill in the following table to show the effect of this ongoing chain of events at each bank.

Assume this process continues, with each successive loan deposited into a checking account and no banks keeping any excess reserves. Under these assumptions, how much is the overall increase of money supply the $5000 reserves result in?