Question 1

Toni had worked as an apprentice baker in a large bakery that supplied different types of bread - from the standard white loaf to the speciality bread such as rye, gluten-free and organic. At the end of her training, she decided to start a small business specialising in producing cakes - in particular, cakes with ornate decorations made from icing sugar - and Danish pastries because she did not want to compete with the large bakeries for the "bread market". As she was close to office buildings, she decided to try and increase her daily cash-flow by selling "fresh-cut" sandwiches.

Having spent most of her savings on purchasing equipment and supplies, renovating shop premises, and employing two shop assistants, she did not want to spend money for an accountant to set up an accounting system. She wondered whether she should base her cost-management system on the system adopted in the large bakery.

As an apprentice, she had not been involved in the management aspects of operating a bakery, and she did not know what sort of information she would need to ensure that she did not lose her investment in her business. She was certain that there was a ready and reasonably large market for her bakery products. She felt that all she needed was a cash-statement each week to show her what her receipts and payments were, and an annual set of accounts to make sure that she was operating at a profit. To ensure that she recovered her costs, she intended to follow the product costing strategy used by the large bakery that she was an apprentice in.

The large bakery produced a variety of bread using highly automated processes. In ascertaining the cost of its different types of bread, the large bakery treated flour as a direct cost. All other costs were treated as indirect costs, and were allocated. It was a simple system that Toni thought she could emulate. However, the large bakery did not produce cakes and pastries. Cakes and pastries require highly specialised

labour skills because the processes may not be easily standardised and automated.

Required:

Toni is relying on weekly cash flow and annual financial accounts to ensure that she remains in business in the long-term. She is also attempting to ensure that her pricing and cost-management strategies are appropriate by adopting the cost management system used in the large bakery. Do you agree with Toni's approach? Support your opinion by addressing the following issues:

a) How does one ensure that a cost-management system provides relevant and useful information?

b) Toni is relying on financial feedback, and the product costing method adopted by the large bakery. What are the strengths and weaknesses of these approaches?

c) Outline any changes you would recommend that would help Toni to manage her business. Explain how your changes would address the weaknesses that you have identified in Toni's proposed system.

Question 2

Zubick Corporation produces and supplies 2 types of component parts to industrial equipment manufacturers. These parts are known as X123 and R907.

There are 2 departments in the factory: the machining and assembly departments.

The machining department has highly automated operations, while assembly has labour-intensive operations.

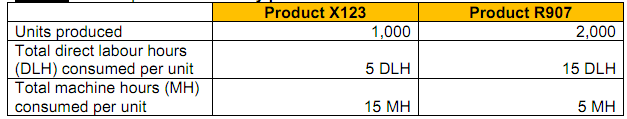

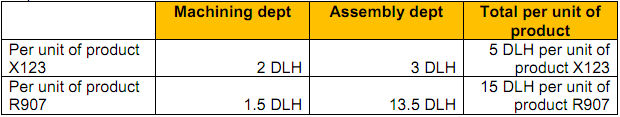

Table 1: Annual production data by product

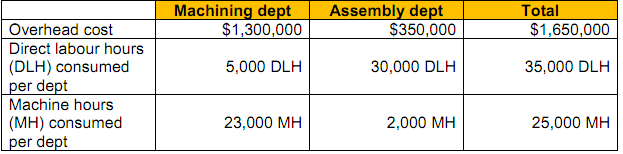

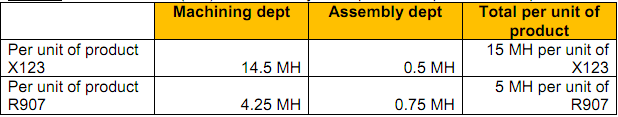

The overhead cost incurred in the Machining department was $1,300,000, while the overhead cost in the Assembly department was $350,000.

Table 2: Annual overhead costs and production activity by department

The manager, Rex, decided to allocate costs to the 2 products in the following manner: he divided the total overhead costs of $1,650,000 by the total number of labour hours utilised in the factory (ie (1000 x5) plus (2000 x 15) = 35,000 DLH).

Therefore his overhead rate was $1,650,000/35,000 = $47.14 per DLH.

The overhead allocated to each product using Rex's rate was as follows:

Product X123 = 5 DLH x$47.14 = $235.70

Product R907 = 15 DLH x $47.14 = $707.10

But Rex was losing sales of product R907 to his competitor who was able to sell a similar product at a lower price, and recover all costs of production.

Table 3: Machine hours (MH) consumed by each product in production departments.

Table 4: Direct labour hours (DLH) consumed by each product in production departments.

Required:

i) Do you agree or disagree with Rex's overhead allocation method? Explain.

ii) How would you improve it? Calculate alternative rates that you would use and explain why you think it would help Rex. You should draw on information provided in Tables 1 to 4 to support your recommendation.