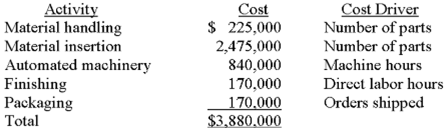

1. HiTech Products manufactures three types of remote-control devices: Economy, Standard, and Deluxe. The company, which uses activity-based costing, has identified five activities (and related cost drivers). Each activity, its budgeted cost, and related cost driver is identified below.

The following information pertains to the three product lines for next year:

What is HiTech's pool rate for the material-handling activity?

What is HiTech's pool rate for the automated machinery activity?

Under an activity-based costing system, what is the per-unit overhead cost of Economy?

Under an activity-based costing system, what is the per-unit overhead cost of Deluxe?

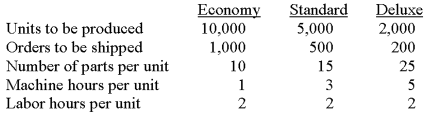

2.Riverside Florists uses an activity-based costing system to compute the cost of making floral bouquets and delivering the bouquets to its commercial customers. Company personnel who earn $180,000 typically perform both tasks; other firm-wide overhead is expected to total $70,000. These costs are allocated as follows:

Riverside anticipates making 20,000 bouquets and 4,000 deliveries in the upcoming year.

The cost of wages and salaries and other overhead that would be charged to each bouquet made is

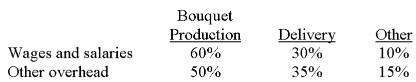

3. St. James, Inc., currently uses traditional costing procedures, applying $800,000 of overhead to products Beta and Zeta on the basis of direct labor hours. The company is considering a shift to activity-based costing and the creation of individual cost pools that will use direct labor hours (DLH), production setups (SU), and number of parts components (PC) as cost drivers. Data on the cost pools and respective driver volumes follow.

The overhead cost allocated to Beta by using traditional costing procedures would be:

The overhead cost allocated to Beta by using activity-based costing procedures would be:

4. Whitt company manufactures a line of electric garden tools that are sold on general hardware stores. The company controller has just received a sales forecast for the coming year for three product lines. (weeders, hedge clippers, and leaf blowers. Whitt has experienced considerable variations in sales volumes and variable costs over the past two years and the controller believes the forecast should be carefully evaluated from a cost volume profit viewpoint. The preliminary budget info for 2012 is presented below.

Weeders Clippers Blowers

Unit sales 50,000 50,000 100,000

Unit selling price 28.00 36.00 48.00

Variable manufacturing cost per unit 13.00 12.00 25.00

Variable selling cost per unit 5.00 4.00 6.00

For 2012 Whitt's fixed factory overhead is budgeted at $2 million, and the companys fixed selling and administrative expanses are forecasted to be $500,000. Whitt has a tax rate of 40 percent.

Assuming that the sales mix remains as budgeted determine how many units of each product Whitt must sell in order to breakeven in 2012?

5. SB Jamal & Co. makes and sells two types of...

[The following information applies to the questions displayed below.]

Jamal & Co. makes and sells two types of shoes, Plain and Fancy. Data concerning these products are as follows:

Sixty percent of the unit sales are Plain, and annual fixed expenses are $45,000.

The weighted-average unit contribution margin is:

Assuming that the sales mix remains constant, the total number of units that Jamal must sell to break even is

Assuming that the sales mix remains constant, the number of units of Plain that Jamal must sell to break even is