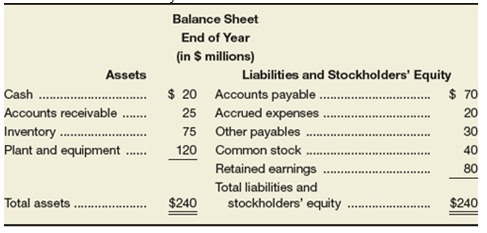

Conn Man's Shops, Inc., a national clothing chain, had sales of $300 million previous year. The business has a steady net profit margin of 8 percent and a dividend payout ratio of the 25 percent. The balance sheet for the end of last year is illustrated below.

The firm's marketing staff has told the president that in coming year there will be a big raise in the demand for overcoats and wool slacks. The sales raise of 15 percent is forecast for the company.

All balance sheet items are predicted to maintain the same percent-of-sales relationships as last year, apart from for common stock and retained earnings. No change is scheduled in the number of common stock shares outstanding and retained earnings will change as dictated by the profits and dividend policy of the firm. (Keep in mind the net profit margin is 8 percent.)

a) Will external financing be needed for the company throughout the coming year?

b) What would be the requirement for external financing if the net profit margin went up to 9.5 percent and the dividend payout ratio was raised to 50 percent? Describe.