Problem 1: Dr. Now is an assistant professor at University of Somewhere. Apart from his work related to university, he runs a car-mechanic shop in City of Somewhere called SMW. He works as the mechanic there repairing cars and he is a only mechanic of the shop. Using his knowledge in statistics, Dr. Now observed that cars are coming to SMW for repair at the rate of 10 per month and the interarrival time is exponentially distributed. Dr. Now could repair cars at the rate of 12 per month. The cars are repaired in a first-come first-served manner.

a) Express Dr. Now’s SMW shop as the queuing system by defining customers, arrival rate and expected interarrival time, server or servers, service rate and expected service time. Utilize Kendall’s notation to define SMW queuing system.

b) Dr. Now parks cars waiting to be repaired inside shop; but, if there is no space left inside the shop, he parks them in the outside parking area. The shop could have 2 cars parked inside shop plus car that is presently being repaired. As parking in the outside parking area is problematic, Dr. Now needs to have cars parked inside the shop at least 75% of the time on average. Does SMW satisfy this criterion? Demonstrate your calculations on how you reached your answer; you could use excel template if required.

c) From each repair, Dr. Now earns $1,000 if the repair is completed within the month. The repair time is the time between car’s arrival for repair and the car is completely repaired. On the other hand, if repair time is more than the month, Dr. Now charges half price of the regular repair; therefore, he earns $500. If Dr. Now earns less than $10,000 per month on average, he would consider closing SMW. Will Dr. Now consider closing SMW? Demonstrate your calculations on how you reached your answer. That is, compute the expected monthly earnings and compare to $10,000. You could use excel template if required.

(For solving d,e,f): In fact, one of his students in his Operations Research class analyzed Dr. Now’s SMW shop and he found out that Dr. Now will consider closing shop. Dr. Now does not know if this student is right or wrong, but he heard the rumours thus decided to take action. He is considering the following two actions:

• Action 1: Increase repair charge to $1,500 and continue on the promotion that if the repair is not finished within a month, charge the half price, i.e., $750. With this new price, the number of customers coming to the shop would reduce and estimated arrival rate would be 7 per month (interarrival time would still be exponential).

• Action 2: Remove promotion, that is charge $1,000 for any repair. Without discount promotion, the number of customers coming to the shop would reduce and the estimated arrival rate would be 9 per month (interarrival time would still be exponential).

Dr. Now will take one of these actions.

d) If he wishes to have shop open, he must earn more than $10,000 per month on average. Would Action 1 guarantee that shop would remain open? Demonstrate your calculations on how you reached your answer; that is, compute the expected monthly earnings with Action 1 and compare to $10,000. You can use excel template if needed.

e) If he wants to have shop open, he must earn more than $10,000 per month on average. Would Action 2 guarantee that the shop would remain open? Demonstrate your calculations on how you reached your answer. That is, compute the expected monthly earnings with Action 2 and compare to $10,000. You could use excel template if needed.

f) Which action must Dr. Now take if he wants to keep SMW open? Would this action satisfy the criterion that cars are being parked inside shop at least 75% of the time? You could use excel template if needed.

Problem 2: Dr. Now is an assistant professor at University of Somewhere. Aside from his work related to the university, he manages a local bank in City of Somewhere called Dino-Bank. He must now decide on how many tellers are needed in the bank. Specifically, Dr. Now hires his students to work as tellers. The interarrival time between customers is exponentially distributed with a mean interarrival time of 30 seconds. Customers arriving at the bank wait in a single line and go to the tellers in a first-come-first served manner. Dr. Now estimates that his students can complete a customer’s transaction in 2 minutes on average and the service time is exponentially distributed.

a) What is the minimum number of students (tellers) Dr. Now has to hire so that Dino-Bank will reach a steady-state, i.e., the Dino-Bank will not ‘blow up’? Briefly describe why.

b) Now, Dr. Now decided to hire minimum number of tellers needed. Each teller is paid at a rate of $12 per hour. And, Dr. Now believes that each customer standing in the line for a minute has a delay cost of 10¢. Compute expected hourly cost of Dino-Bank with the minimum number of tellers needed. Expected hourly cost is equal to teller costs plus expected delay costs. You could use excel template if required.

c) Will adding one teller decrease or increase the expected hourly cost of Dino-Bank? You can use excel template if needed.

d) Dr. Now thinks that adding another teller would not help. After thinking about Dino-Bank for days and days, he came up with following idea: instead of having a single line with minimum number of tellers needed, he would have 5 different lines such that each line is for each individual teller. In this case, he would manage customer arrivals such that customers arrive at each teller’s line with the mean interarrival time of 2.5 minutes, which is exponentially distributed. Each teller would still have exponential service time distribution with mean service time of 2 minutes. Still, each customer standing in the line for a minute has a delay cost of 10¢. Will the idea of having separate lines reduce expected costs compared to the expected costs with the single line and the minimum number of tellers needed (i.e., the expected cost calculated in part b)? (Hint: each teller is a separate but identical queuing system under the new idea).

(For solving e,f,g,h,i): Assume that Dr. Now decided that new idea is not good and he would continue with the single line and the minimum number of servers. Now, answer the following questions about Dino-Bank independent of each other and briefly describe your answers:

e) If service time of each teller is reduced by same amount and still exponentially distributed, would the average number of people waiting in the line increase or decrease? Describe why?

f) If one more extra server, with similar characteristics with other tellers, is hired, will Dino-Bank be subject to higher or lower delay costs? Describe why?

g) Assume that Fridays are busier than other days; therefore, the arrival rate of the customers increases. Will this increase or decrease the expected delay costs? Describe why?

h) Instead of working with multiple student tellers, Dr. Now decided to be single teller of Dino-Bank as he could complete a customer transaction way faster than his students and he works for lower salaries. He could complete 3 customer transactions per minute. The customer interarrival time is still exponentially distributed with mean of 30 seconds. As Dr. now does not like staying idle, whenever there is no customer in Dino-Bank, he plays Angry-birds. What percentage of time Dr. Now is playing Angry birds? Describe why?

i) Still assume that Dr. Now is single teller and Fridays are busier than other days. Will this increase the difference between the expected number of people in Dino-Bank and the expected number of people in the line? describe why?

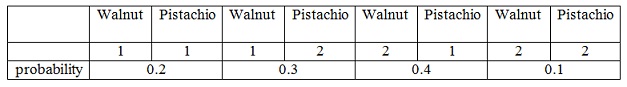

Problem 3: Assume that Dr. Now operates a local grocery store in City of Somewhere named Dino-cery. Dino-cery’s best product is the authentic baklavas that Dr. Now ships from the Turkish restraint in St. Louis at the beginning of each week. He ships and sells two types of baklavas: walnut and pistachio. Dr. Now observed the following weekly demand for trays of baklavas sold:

For example, 1-tray of walnut and 2-trays of pistachio baklavas would be sold in a week with probability of 0.3. Each tray of walnut baklava costs Dr. Now $100 and sold for $250. Each tray of pistachio baklava costs Dr. Now $125 and sold for $300. Each unsold tray of baklava is perished so it is wasted. There is no cost associated with an unsatisfied customer. Dr. Now now wants to decide on how many trays of each baklava type he should buy at the beginning of each week. He is only considering buying 1 or 2 trays of each baklava type.

a) Express Dr. Now’s baklava purchase problem as a decision analysis problem. Formulate a decision analysis problem by constructing the payoff table with the information given above. That is, describe your alternatives, states of natures, and calculate the payoff (profit) for each alternative and state of nature pair, and note the prior probabilities for each state of nature.

b) Based on maximax criterion, how many trays of each baklava type Dr. Now should buy?

c) Based on minimax criterion, how many trays of each baklava type Dr. Now should buy?

d) Based on maximum likelihood criterion, how many trays of each baklava type Dr. Now must buy?

e) Based on Baye’s decision rule, how many trays of each baklava type Dr. Now must buy?