Question 1: Between 1990 and 2000, the standard deviation of returns for the NIKKEI and the DJIA indexes were 0.18 and 0.16, correspondingly and the covariance of these index returns was 0.003. Determine the correlation coefficient between the two market indicators?

a) 9.6

b) 0.0187

c) 0.1042

d) 0.0166

e) 0.343

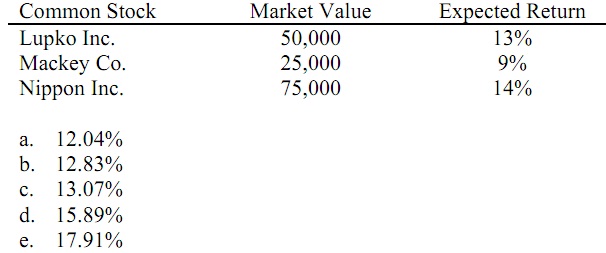

Question 2: What is the expected return of the three-stock portfolio explained below?

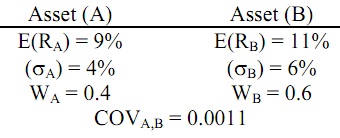

USE THE GIVEN INFORMATION FOR THE NEXT PROBLEM(S):

Question 3: Refer to above information, What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation (σi), covariance (COVi,j), and asset weight (Wi) are as illustrated above?

a) 8.95%

b) 9.30%

c) 9.95%

d) 10.20%

e) 10.70%

Question 4: Refer to above information. What is the standard deviation of this portfolio?

a) 3.68%

b) 4.56%

c) 4.99%

d) 5.16%

e) 6.02%

Question 5: Consider two securities, A and B. Security A and B have a correlation coefficient of 0.65. Security A has standard deviation of 12 and security B has standard deviation of 25. Compute the covariance between such two securities.

a) 300

b) 461.54

c) 261.54

d) 195

e) 200

Question 6: Which of the given is not a supposition of the Capital Market Theory?

a) All investors are Markowitz efficient investors.

b) All investors have homogeneous expectations.

c) There are no taxes or transaction costs in buying or selling assets.

d) All investments are indivisible so it is not possible to buy or sell fractional shares.

e) All investors have similar one period time horizon.

Question 7: What does WRF = - 0.50 mean?

a) The investor can borrow money at the risk-free rate.

b) The investor can lend money at the present market rate.

c) The investor can borrow money at the present market rate.

d) The investor can borrow money at the prime rate of interest.

e) The investor can lend money at the prime rate of interest.

Question 8: When recognizing undervalued and overvalued assets, which of the given statements are false?

a) An asset is properly valued if its estimated rate of return is equivalent to its required rate of return.

b) An asset is considered overvalued if its estimated rate of return is below its required rate of return.

c) An asset is considered undervalued if its estimated rate of return is above its required rate of return.

d) An asset is considered overvalued if its required rate of return is below its estimated rate of return.

e) None of the above.

Question 9: A completely diversified portfolio would have a correlation with the market portfolio which is:

a) Equal to zero as it has only unsystematic risk.

b) Equal to one as it has only systematic risk.

c) Less than zero as it has only systematic risk.

d) Less than one as it has only unsystematic risk.

e) Less than one as it has only systematic risk.

Question 10: Compute the expected return for E Services that has a beta of 1.5 when the risk free rate is 0.05 and you expect the market return to be 0.11.

a) 10.6%

b) 12.1%

c) 13.6%

d) 14.0%

e) 16.2%