Question 1:

According to analytical procedures are defined as follow:

....the term means evaluations of financial information through analysis of plausible relationships among both financial and non-financial data...

Required:

Identify and explain the most important reasons for performing analytical procedures.

Question 2:

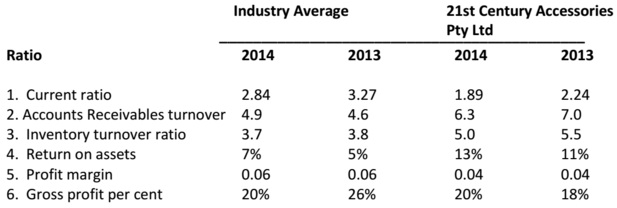

You are the audit senior on the audit of 21st Century Accessories Pty Ltd, a large distributor of technology accessories, whose main market lies in the 18-24 age group.

This is the first year your audit firm has performed the audit. As part of the planning work, you have performed analytical procedures on an annualised basis and compared the results to industry averages and lasts year’s audited financial information. The results are given below:

Required:

Based on the information given:

(i) explain the general meaning of each of the above ratios;

(ii) discuss the conclusions that you can draw about 21st Century Accessories Pty Ltd financial position; and

(iii) identify potential audit risks to be investigated further.

You may wish to present your answers to (i), (ii) and (iii) in the form of a table:

Question 3:

During the planning stage of the BEN Logistics Ltd (BEN) audit for FY 2015, you discover the following matters when reviewing the company’s payroll computer system:

1. When hiring or terminating an employee, the payroll officer prepares the paperwork and enters the information into the master file of the payroll computer system.

2. Payroll is processed on a weekly basis by the payroll department at BEN’s head office. All timesheets submitted by factory workers are signed off by the factory manager. The timesheets are entered into the computer by the factory manager and payment is then made by the payroll department.

Required:

(a) For each of matters 1 and 2 above:

(i) Outline one (1) weakness in the payroll control activities.

(ii) Describe how each internal control weakness in (a) (i) above could lead to material misstatement in the financial statements.

(b) For each weakness provided in your response to (a) (i) above describe one (1) practical manual control to prevent the material misstatement described in (a) (ii) above.

You may wish to present your answers to (a) and (b) in the form of a table:

Submission Instructions:

- The font style for your answer should be set to “Time New Roman” size 12 with 1.5 line spacing, 2.5cm margin & A4 page layout.

- The assignment should be typed and a cover sheet attached.