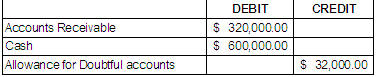

Eraesi Company, which uses the perpetual inventory system, began operations on January 1, 2010. At January 1, 2011, the Company reports the following balances.

During the year, the company completed the following transactions involving sales on credit, accounts receivable collections, and bad debts.

a. Sold goods worth $3,475,000 on credit. The cost of these goods was $2,800,000

b. Received $3,150,000 cash from customers for the goods sold on credit.

c. Wrote off $62,000 of uncollectible accounts receivable.

d. The company estimates that 10% of its accounts receivable will be uncollectible.

Required:

A. Record the journal entries for the above select transactions

B. Show how the accounts receivable and the allowance for doubtful accounts appear on the Dec 31, 2011 balance sheet.