Question 1:

Describe the suppositions and implications of earnings approach to equity valuation.

Question 2:

Illustrate the quantitative models of equity valuation? Also explain their limitations?

Question 3:

Describe the advantages and disadvantages of the dividend discount model to valuation.

Question 4:

In brief describe the different equity valuation approaches. Which do you think is a more realistic application for investors?

Question 5:

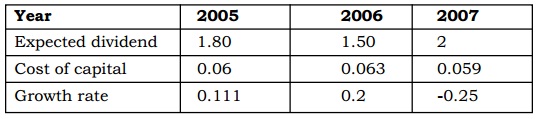

Given are the financial forecasts of a company for three years. Calculate the value of its share.