Problem 1: The draft accounts for Commentary Ltd for the year ended 31st December 2005 are shown below:

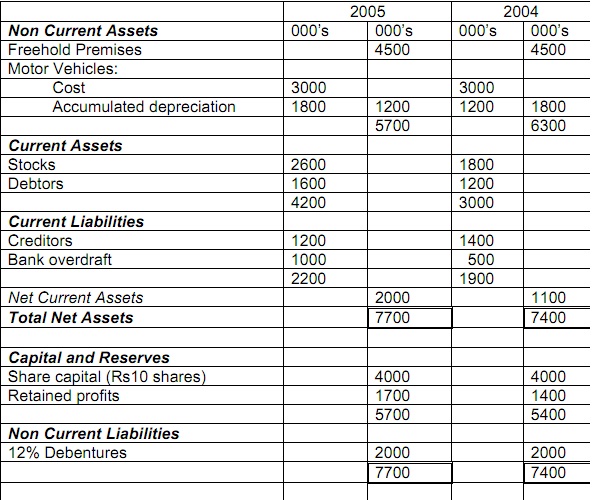

Draft Balance Sheet as at 31 December 2005

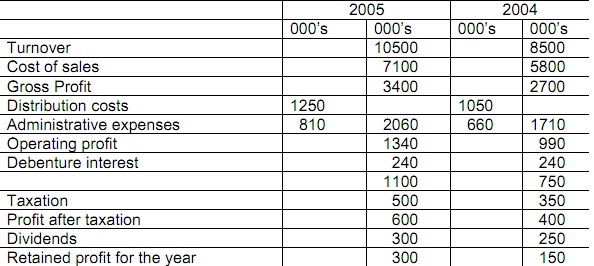

Draft Profit and Loss Account for the year ended 31 December 2005

Required:

When the draft accounts were presented to the board of directors (none of whom has had any training in accounting, except you) the following points were raised by board members. Reply to each of these points in clear and simple terms, avoiding the use of unexplained accounting ‘jargon’. Where appropriate, support your replies with calculations, which account up to.

Question1. ‘It does not seem to do us much good to make profits; our cash position seems to go from worse to worse.’ Does it imply that we may face liquidity problems?

Question2. ‘What is our gearing level and is it worthwhile to take further loans to expand the business?

Question3. ‘We seem to have let control over our debtors and stocks slip such that the amount we have tied up in these items has increased alarmingly. Is there any simple way of measuring how seriously we have strayed from our previous patterns? What is our current cash operating cycle?

Question4. ‘What is our rate of return on capital employed? Does it make sense to compare that figure with those of other companies as a test of our performance?’

Question5. ‘I am told that financial analysts judge a company on its earnings per share. What is this figure for Commentary and what does it mean?’