Question 1: Dividend Policy

Morning Star (www.morningstar.co.uk) conducted a search to reveal the top dividend-paying stocks on the FTSE 350. The data was collected in October 2012 and the list of 20 large and midcap companies with dividend yield figures (ranging from 5.9% to just over 14% for the 12 months period) is available at:

https://www.morningstar.co.uk/uk/news/95410/top-20-high-yielding-stocks.aspx

Required:

Critically assess how companies set their dividend policies, and describe the factors that a company will consider in setting its dividend policy and in finding out the level of dividend to be paid. Support your arguments by reference to ONE of the top 20 companies listed in the webpage of Morning Star mentioned above.

Your comments must incorporate both theoretical/academic arguments and real world practices. You must research the subject beyond the basic facts and should provide references and critical commentary to support the points. You should as well provide a short introduction on the key issues and a conclusion consistent to your discussion.

Question 2: Working Capital Policy

Required:

Critically assess how companies set their working capital policies and elucidate the factors that a company must consider in setting its working capital policy and in finding out the level of working capital to be maintained.

Support your arguments by reference to TWO FTSE250 companies in the same industry.

The description must emphasize the trade-off relationship between liquidity and profitability with reference to conservative, moderate and aggressive working capital policies. Your comments must incorporate both theoretical/academic arguments and real world practices. You should research the subject beyond the basic facts, and must provide computations, references and critical commentary to support the points. You should as well provide a brief introduction on the key issues and a conclusion consistent to your discussion.

Note: You can visit the link below to choose one industry of your choice from the available list of industries. Please note both companies should come from the same industry. You are recommended not to use banks, and companies engaged in financial services.

https://www.londonstockexchange.com/exchange/prices-and-markets/stocks/indices/constituents-indices.html?index=MCX

Question 3: Cost of Capital/Investment Appraisal

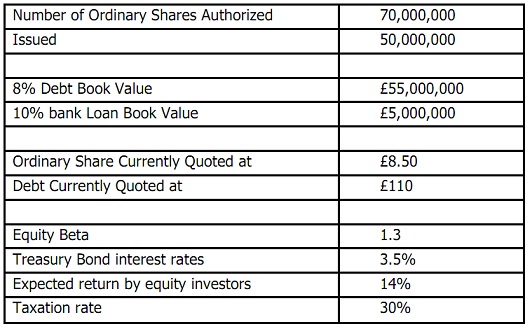

You have been appointed as the financial manager for Decido PLC and have been tasked with calculating their weighted average cost of capital.

Based on preliminary information accessible from the financial statements, you have been able to extract the given:

Decido will have to settle the 8% convertible debt at par in 8 year time

Required:

a) Calculate the market value weighted average cost of capital of Decido stating and justifying any suppositions made.

b) Discuss the conditions under which the WACC is ideal for use in an Investment appraisal. This discussion must describe:

- Business and financial risk

- Their impact on WACC

- An explanation of how some types of risk require an adjustment to WACC and how these adjustments are done

c) Discuss whether the dividend growth model or the Capital Asset Pricing Model offers a better estimate of a company’s cost of capital. An in-depth analysis, assessing the pros and cons of both methods, is expected.