Assignment:

Part 1:

Question 1. Inflation

You gained access to the information on the composition of the consumer basket. Also, you know that the price index in 2016 was 240.(a) Find the cost of the 2016 basket in 2016 prices

(b) Find the cost of the 2016 basket in 2017 prices

(c) Use the proportion method to find the CPI of 2017

(d) Calculate inflation as the growth rate of CPI.

(e) Your results are biased because the composition of the basket changed. Use chained inflation method to account for the change. That is, repeat (a)-(d), but use the 2017 basket. Then take the average between the inflation you find and your result in (d).

(f) If one compares your result to the core inflation indicator, which one do you think will be higher? Explain the reason concisely (notice how prices of food and energy change).

Question 2. Inflation and sticky contracts

The workers negotiate a 2% raise in their nominal wage. They anticipate inflation of 2%.

(a) The inflation amounts to 1%. Is the worker's real wage lower or higher than they anticipated?

(b) Given your answer to (a), what can you say about the firms' profitability?

(c) Do you expect firms to fire or hire workers? Would you expect the nominal wages to go up or down? Explain. (hint: think deflationary scenarios such as the Great Depression or Greece).

(d) Assume that the economy was at the natural level of unemployment at the moment the wages were set. What kind of output gap do you think is taking place after the events of (c)? Is the cyclical unemployment positive or negative?

Question 3. International finance

Only the following international transactions take place in the US during the year 2017:

1. Canada exports $50 worth of electricity to Buffalo

2. Delta carries 10 passengers across the Atlantic, of which 8 are foreigners. The ticket price is $5.

3. Foreign workers send $12 to their families home

4. J.K. Rowling collects $5 in royalties from selling her books around the US through an American publisher.

5. BMW builds a $20 factory in Alabama

6. Foreigners buy $5 worth of US Treasury bills.

(a) Compose the statement of international transactions

Current account:

Exports

Imports

Capital incomes

Labor Incomes

Unilateral (current) transfers

Financial account:

Foreign direct investment

Portfolio investment

Loans made

Change in currency reserves

(b) Calculate the trade balance, current account, and the financial account (assume there is no statistical discrepancy)

(c) At the beginning of the year, the US owed $90 in foreign claims on the US-located assets. Calculate the percentage change in the US external debt.

Question 4. Economic growth and development

There are 150 workers with jobs and 200 units of capital in the country. The level of technology is 20. The output of the country follows the Cobb-Douglas production function:

Marginal products of production factors and technology are given by

(a) Calculate GDP and the marginal products and .

(b) Two workers arrive into the economy and get jobs. Capital stays the same. The new GDP is 3574. Use your result from (a) in the growth accounting formula to find the growth rate of technology.

(c) Without any calculations, do you think the marginal product of capital increased or decreased in the country? Explain using the formula for marginal product.

(d) List the features of society that you think increase economic growth

Part 2:

Question 1. Functions, properties of money, and monetary regimes

In your opinion, in modern American society, bitcoin:

serves the following functions of money:

doesn't serve the functions below:

furthermore, bitcoin:

shares the properties of money below:

doesn't share the properties below:

Based on the lists you made, conclude whether bitcoin is or is not money

Note: if you are not comfortable discussing bitcoin, discuss gold in this question instead.

Question 2. Creation of money.

The monetary system begins with the Fed buying a batch of T-bills on the open market. The banks take the paper cash and give out the first round of loans: $373.5. Every bank in the country maintains a 17% reserve rate.

(a) What is the size of the monetary base in the economy?

(b) Borrowers in the country keep $112.05 in cash and deposit 261.45 on their checking accounts. Find the currency drain rate of the population.

(c) Now that one round of loans was made, find the monetary aggregates M0 and M1 in the economy.

(d) With the above MB, reserve rate and currency drain rate, what will the ultimate size of M0, deposits, and M1 be in the economy?

Question 3. The US Federal Reserve.

(a) Draw arrows to connect the Fed entities and their functions/features:

|

Chairman of the Federal Reserve Bank of New York

|

|

Is reappointed every two years

|

|

FOMC

|

|

Ensures equal representation of all social strata in the Fed

|

|

Trading Desk

|

|

Lends money to commercial banks

|

|

Board of Governors

|

|

Has constant representation on FOMC

|

|

Regional Federal Reserve Banks

|

|

Makes decisions to buy and sell T-bills

|

|

Discount window

|

|

Engages in open market operations

|

|

A governor of the Fed

|

|

Has seven members

|

(b) Which of these people is the current chair of the Fed?

(c) If you were an employee of the Fed, how would you answer the popular question "where's my bailout?". Please be concise.

Question 4. Policy instruments

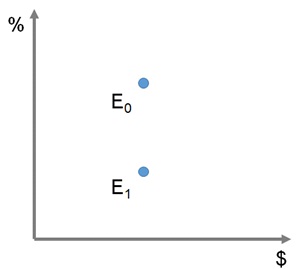

(a) The graph below shows the money market equilibria before and after the Fed's policy intervention. You know that only one conventional policy instrument was used. Complete the graph and suggest which instrument it was.

(b) If the Fed is attempting to stimulate the economy with an expansionary monetary policy, what should it do with regard to each conventional policy tool (circle the right ones)? Note that some of the suggestions on the list are not even policy tools at all and should be ignored.

|

Increase the monetary base

|

|

Decrease the monetary base

|

|

Increase the required reserve rate

|

|

Decrease the required reserve rate

|

|

Print more money

|

|

Print less money

|

|

Impose lower discount rates

|

|

Adopt higher discount rates

|

|

Pay higher interest on reserves

|

|

Pay lower interest on reserves

|

(c) Both the open market operations (OMO) and quantitative easing (QE) involve purchases of assets by the Fed in exchange for paper cash.

What assets are bought in each case?

Why was QE effective in the 2008 crisis, whereas OMO were not?

Hint: compare the risk of assets bought in OMO and QE.

Question 5. Equilibrium on the money market

The economy produces 15000 units of goods. Each good costs $8. Every dollar is spent three times a year on average.

(a) Find the money mass that would facilitate transactions and ensure price stability in this economy.

(b) One of the events during the financial crisis, "credit crunch", involved banks frantically trying to round up as much cash as possible to increase resilience at the cost of profitability. What do you think happened to:

|

Velocity of circulation

|

|

|

|

Increased

|

Remained the same

|

Decreased

|

|

Transactional demand for money

|

|

|

|

Increased

|

Remained the same

|

Decreased

|

|

Liquidity preference

|

|

|

|

Increased

|

Remained the same

|

Decreased

|

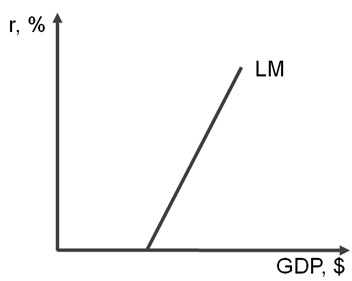

(c) Show how the shock from (b) would affect the LM curve in the figure below: