Financial Dilemma:

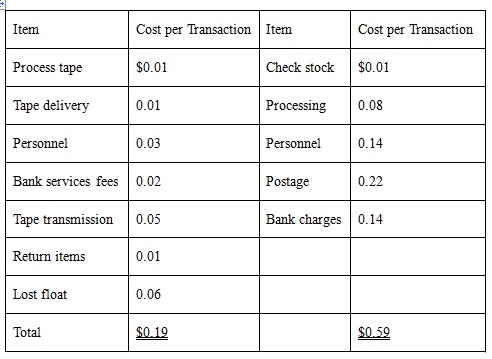

Many companies are wondering if they should emulate Sears, Roebuck & Company in its implementation of electronic disbursing. After negotiating new payment terms with each of its suppliers, it quickly built up a significant volume of electronic payments: 1,000 transactions, 60,000 invoices, and $500 million in payment per month. When evaluating electronic payments, Sears calculated that it would save $0.40 and the payee as much as $1.10 per payment by going through the automated clearinghouse (ACH). The savings to Sears as payor was based on the difference between per-check cost and the ACH payment cost. (note that the postage cost has gone up significantly since then):

ACH CORPORATE TRADE PAYMENTS CHECKS

Question: Using the data from Financial Dilemma, rework the NPV analysis for each of the following situations. For each situation in parts a-d, assume all data are the same as that given in the textbook analysis except the one item indicated. In part e, assume all four changes indicated in parts a-d are applicable. Make a recommendation either for or against the ACH disbursement system in each case.

If you have access to spreadsheet software, you can save time by developing a worksheet or by using a preprogrammed worksheet.

1) The initial investment is $60,000 instead of $40,000

2) The company makes 5,000 payments per month instead of 1,000

3) The annual interest rate is 5% instead of 10%

4) The per-payment saving is $1 instead of $0.40

5) All the changes in parts a-d are applicable