Question 1: You are the Cost Accountant of an industrial concern and have been assigned the responsibility of developing a cost accounting system. Initially it has been decided to make three production cost centers and two service cost centers.

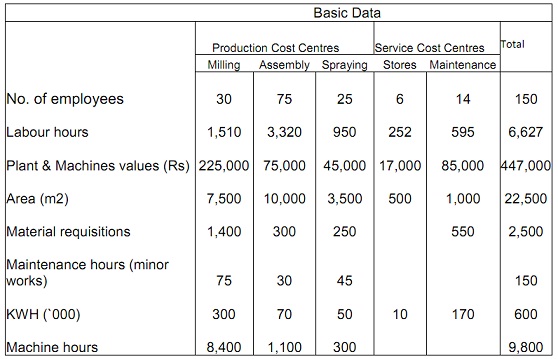

The given data relating to the next accounting period have been estimated as shown below:

Throughout the period the given data were recorded:

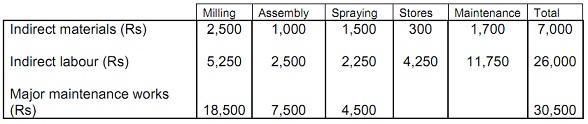

The given details were obtained from the accounts concerning to the period:

Rs

Fire Insurance 1,250

Power 4,500

Heating and Lighting 2,000

Rates 1,800

Machine depreciation 8,400

Machine Insurance 850

Canteen deficit 4,250

Balance of maintenance costs (excl. major works) 17,500

Required:

a) Make an overhead analysis sheet showing how overhead costs must be apportioned between the departments.

b) Compute appropriate overhead absorption rates for the Milling, Assembly and Spraying departments, stating clearly the overhead absorption basis used.

Question 2: The daughter of the managing director of ABC Ltd. is attending a university degree course in accounting and finance. Throughout a telephone call to his daughter the managing director asked her to enquire from her lecturers which of the given is accurate when considering allocation, apportionment and reapportionment of overheads in an absorption costing condition:

a) Only production associated costs must be considered.

b) Allocation is the condition where part of an overhead is assigned to a cost centre.

c) Costs might only be reapportioned from production centers to service centers.

d) Any overheads assigned to a single department must be ignored.

Required: In brief describe what must be the advice of the lecturers to the Managing Director’s daughter.

Question 3: Activity Based Costing is a costing model which re-examines the problem which has faced accountants and accounting technicians for decades-that of the allocation and absorption of overhead. As such Activity Based Costing or ABC provides a workable and more efficient insight into overhead.

Required: In brief explain on three uses and three limitations to the Activity Based Costing system.