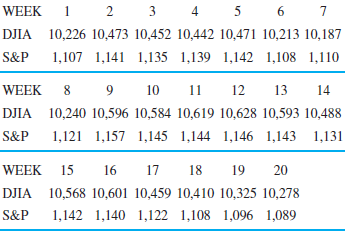

Tim Cooper plans to invest money in a mutual fund that is tied to one of the major market indices, either the S&P 500 or the Dow Jones Industrial Average. To obtain even more diversification, Tim has thought about investing in both of these. To determine whether investing in two funds would help, Tim decided to take 20 weeks of data and compare the two markets. The closing price for each index is shown in the table below:�

Develop a regression model that would predict the DJIA based on the S&P 500 index. Based on this model, what would you expect the DJIA to be when the S&P is 1,100? What is the correlation coefficient (r) between the twomarkets?