Assignment:

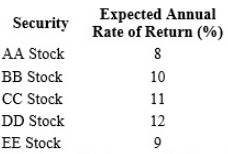

On January 1, 20XX, your company's net cash position shows excess cash of $2,000,000 and management has tasked you with determining which securities the firm should invest in to maximize its return on investment. Below is a chart depicting five management-selected stocks and expected results:

Management has placed the following restrictions on stock investments

- EE Stock cannot exceed 30% of the total funds available.

- DD Stock may not exceed 10% of the funds invested in AA, BB, and

- CC Stocks BB Stock plus CC Stock may not exceed the funds invested in AA Stock.

- CC Stock plus DD Stock may not exceed the funds invested in EE Stock.

a. Develop a portfolio model based on the information given in the scenario.

b. Determine how much of the $2,000,000 should be invested in each stock.

c. What is the expected total return on investment in dollars given your model? And as a percentage of the investment?

d. After your company prepared its annual budget, management has determined the company will have an additional $1,000,000 to invest on July 1, 20XX. Assuming the same security choices and corresponding rate of returns, as well as the management restrictions given above, develop a new portfolio model for this additional investment from July 1 to December 31, 20XX.

e. How much of the $1,000,000 should be invested in each stock based on your new model?

f. What is the expected return on investment in dollars given your new model? And as a percentage of total investment?

g. What is the total expected return for the year in dollars?