Response te following:

Questions

Assume that there are three assets available. A is a risk-free asset with that yields a rate of 8%. The other two assets, B and S are risky asset with the following attributes.

Asset Expected Return Standard deviation

A

B 12% 15%

S 20% 30%

Correlation between assets B and S is 0.1.

Question 1:

To determine the investment proportions in the minimum-variance portfolio of the two risky assets, the expected value and standard deviation of its rate of return. I did the following : {see attachment}

Question 2:

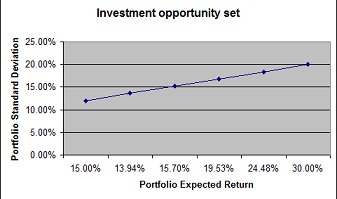

To draw the investment opportunity set of the two risky funds. I used investment proportions for the stock funds of zero to 100% in increments of 20%.

Tabulate the investment opportunity set of the two risky funds {see attachment}

|

Investment Proportion of Stock Fund

|

Investment Proportion of Bond Fund

|

Portfolio Standard Deviation

|

Portfolio Expected Return

|

|

0.00%

|

100.00%

|

15.00%

|

12.00%

|

|

20.00%

|

80.00%

|

13.94%

|

13.60%

|

|

40.00%

|

60.00%

|

15.70%

|

15.20%

|

|

60.00%

|

40.00%

|

19.53%

|

16.80%

|

|

80.00%

|

20.00%

|

24.48%

|

18.40%

|

|

100.00%

|

0.00%

|

30.00%

|

20.00%

|

Draw the investment opportunity set of the two risky funds

Question 3:

If using only risky assets S, and B, to set up portfolio to yield an expected return of 14%, I did the following {see attachment}

|

Investment Proportion of Stock Fund

|

Investment Proportion of Bond Fund

|

Portfolio Standard Deviation

|

Portfolio Expected Return

|

|

25.00%

|

75.00%

|

14.13%

|

14.00%

|

Question 4:

Using all three assets A, B, and S, how can I set up portfolio to yield an expected return of 14%? What would be the standard deviation this portfolio? What proportion of each asset invested?

Question 5:

Assuming the borrowing is not allow, to construct a portfolio of only risky assets S, and B, with an expected return of 24%. What would be appropriated portfolio proportions? Consequently, what are their standard deviations? If the borrowing is allowed at the risk free rate, how much less the standard deviation would be?