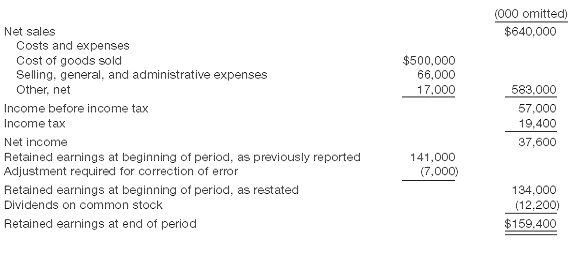

Presented below is a combined single-step income and retained earnings statement for Nerwin Company for 2012.

Additional facts are as follows.

1. Selling, general, and administrative expenses?? for 2012 included a charge of $8,500,000 that was usual but infrequently occurring.

2. Other, net?? for 2012 included an extraordinary item (charge) of $6,000,000. If the extraordinary item (charge) had not occurred, income taxes for 2012 would have been $21,400,000 instead of $19,400,000.

3. Adjustment required for correction of an error?? was a result of a change in estimate (useful life of certain assets reduced to 8 years and a catch-up adjustment made).

4. Nerwin Company disclosed earnings per common share for net income in the notes to the financial statements.

Instructions

Determine from these additional facts whether the presentation of the facts in the Nerwin Company income and retained earnings statement is appropriate. If the presentation is not appropriate, describe the appropriate presentation and discuss its theoretical rationale. (Do not prepare a revisedstatement.)