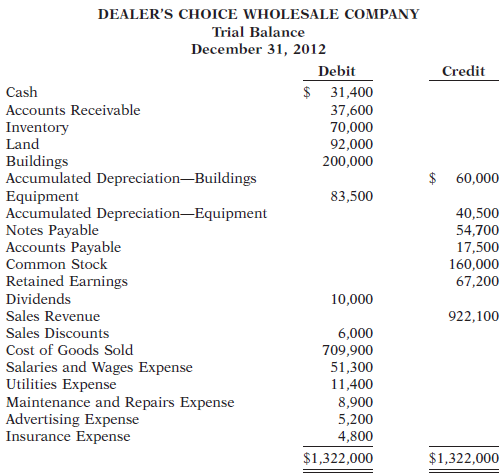

The trial balance of Dealer's Choice Wholesale Company contained the accounts shown at December 31, the end of the company's fiscal year.�

Adjustment data:

1. Depreciation is $8,000 on buildings and $7,000 on equipment. (Both are operating expenses.)

2. Interest of $4,500 is due and unpaid on notes payable at December 31.

3. Income tax due and unpaid at December 31 is $24,000.

Other data: $15,000 of the notes payable are payable next year.

Instructions

(a) Journalize the adjusting entries.

(b) Create T accounts for all accounts used in part (a). Enter the trial balance amounts into the T accounts and post the adjusting entries.

(c) Prepare an adjusted trial balance.

(d) Prepare a multiple-step income statement and a retained earnings statement for the year, and a classified balance sheet at December 31,2012.