Problem: Suppose a local coffee shop knows that its elasticity of demand is 0.2. Would you recommend that the coffee shop increase its price by 20%? Why or why not?

Suppose a cigarette manufacturer knows that its elasticity of demand is 1.3. Would you recommend that they raise price by 20%? Why or why not?

Would government be better off taxing gasoline or Nike tennis shoes? Use the concept of elasticity (or inelasticity) of demand to defend your choice

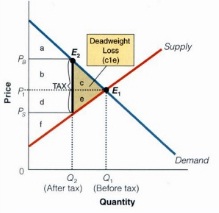

Define the following:

a. Consumer surplus

b. Producer surplus

c. Total welfare

d. Deadweight loss

Refer the above diagram. Explain the effects of a tax on consumer and producer surplus. Explain what happens to total welfare when government levies a per-unit tax on a good. Use the concept of deadweight loss in your explanation

What are the two characteristics that must be met for a good to be considered a "public good?" Give an example of the "free rider" problem and explain why the good or service is subject to this problem.