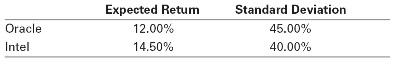

1.A hedge fund has created a portfolio using just two stocks. It has shorted $35,000,000 worth of Oracle stock and has purchased $85,000,000 of Intel stock. The correlation between Oracle’s and Intel’s returns is 0.65. The expected returns and standard deviations of the two stocks are given in the table below:

a. What is the expected return of the hedge fund’s portfolio?

b. What is the standard deviation of the hedge fund’s portfolio?

2.Consider the portfolio in Problem 26. Suppose the correlation between Intel and Oracle’s stock increases, but nothing else changes. Would the portfolio be more or less risky with this change?

3.Fred holds a portfolio with a 30% volatility. He decides to short sell a small amount of stock with a 40% volatility and use the proceeds to invest more in his portfolio. If this transaction reduces the risk of his portfolio, what is the minimum possible correlation between the stock he shorted and his original portfolio?

4.Suppose Target’s stock has an expected return of 20% and a volatility of 40%, Hershey’s stock has an expected return of 12% and a volatility of 30%, and these two stocks are uncorrelated.

a. What is the expected return and volatility of an equally weighted portfolio of the two stocks? Consider a new stock with an expected return of 16% and a volatility of 30%. Suppose this new stock is uncorrelated with Target’s and Hershey’s stock.

b. Is holding this stock alone attractive compared to holding the portfolio in (a)?

c. Can you improve upon your portfolio in (a) by adding this new stock to your portfolio? Explain.