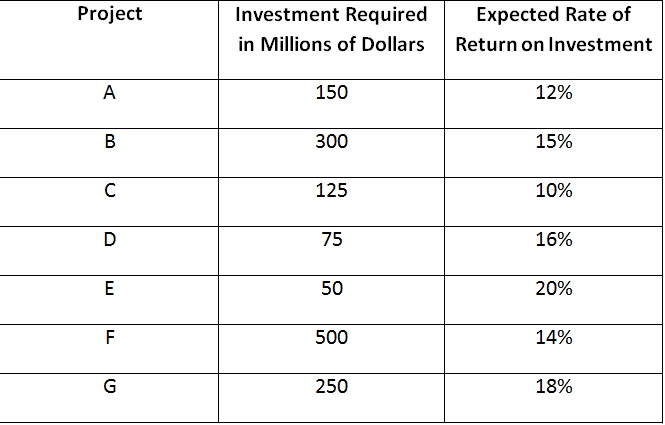

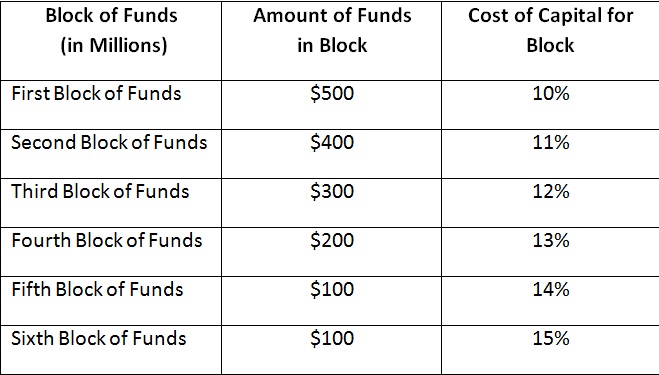

Question1. Use concepts of marginal cost and marginal revenue to derive an optimal capital budget for Company X, which has identified seven probable investment projects and determined its cost of capital as given below.

Table: Alternative Projects, Required Investments, and Expected Rate of Return

Table: Cost of Capital by Amount Raised

Question2. Compare the three investments below in terms of their riskiness. What is the best manner to calculate the riskiness of the investment given the information you have on them?

Project Expected Return Standard Deviation

A $100,000 $25,000

B $200,000 $40,000

C $50,000 $20,000

Question3. Find out the derivatives of each of the subsequent functions, and their points of maximization or minimization if probable.

a. TC = 1500 - 100 Q + 2Q2

b. ATC = 1500/Q - 100 + 2Q

c. MC = -100 +4Q

d. Q = 550 – 0.5 P

e. Profits = -1500 +1200 Q – 4Q2