Question 1) Part A

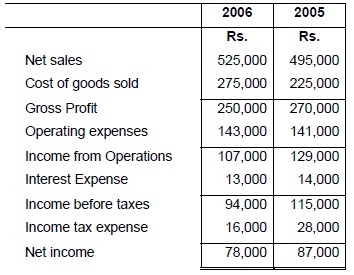

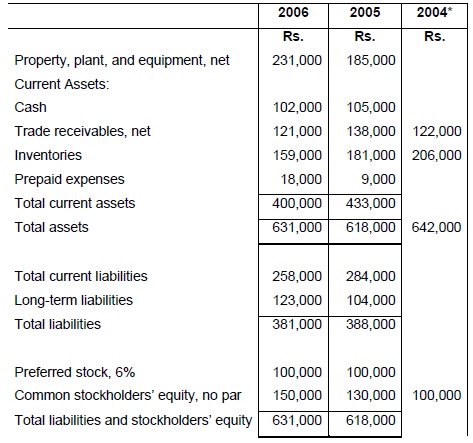

Julius Caesar, Inc. needs to analyze results of his trading for the year ended 31 December 2006 and has prepared his Income Statement and Balance Sheet. He compares these with finals accounts for the previous year. Comparative financial-statement data of Julius Caesar, Inc. follow.

Other Information:

1. Market price of Caesar’s common stock: Rs 42.50 at December 31, 2006, and Rs 53 at December 31, 2005.

2. Common shares outstanding: 20,000 during 2006 and 18,000 during 2005.

3. All sales on credit.

Required:

(a) Compute the following ratios to two decimal places for each of the years ended 31 December 2006 and 2005.

a. Gross profit margin

b. Net profit margin

c. Earnings per share of common stock

d. Price/earnings ratio

e. Return on total assets

f. Current ratio

g. Acid test ratio

h. Times-interest-earned ratio

i. Inventory turnover

j. Debtors Period

(b) Decide:

(i) whether Caesar’s ability to pay debts and to sell inventory improved or deteriorated during 2006 and

(ii) whether investment attractiveness of its common stock appears to have increased or decreased.