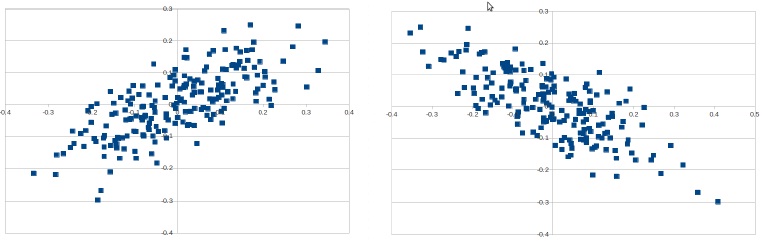

1. The figure above is a scatter plot of the returns of two assets against the return of the market. Both assets have the same expected return and the same variance. Which asset would you prefer to hold if your portfolio contained many stocks? Asset 1 is on the left and Asset 2 on the right.

(a) Asset 1

(b) Asset 2

2. You have to pick one stock that will form your entire portfolio. Which stock will you not pick?

Stock Expected return Std.Dev.

A 10 15

B 9 13

C 5 15

D 10 8

(a) Stock A

(b) Stocks A, B, and C

(c) Stock D

(d) Stocks B and C

Answer the next three questions with reference to this information

Form a portfolio of stocks X and Y and the risk-free asset, such that the standard deviation of my portfolio's return will be 13%. The correlation between these two assets is 0, and that the standard deviations of the two assets are 10% and 15% respectively. You know that the tangency portfolio of just these two risky assets invests 2/3 in asset X.

3. What is the standard deviation of the return of the tangency portfolio?

(a) 8.33%

(b) 11.11%

(c) 12%

(d) 13%

4. Assuming you invest a positive amount in the risky asset, what is the weight of the risky asset in your final portfolio?

(a) -0.56

(b) 0.083

(c) 0.44

(d) 1.56

5. If you had $200 to invest, how many dollars would you invest in asset X?

(a) 133.33

(b) 192

(c) 200

(d) 208

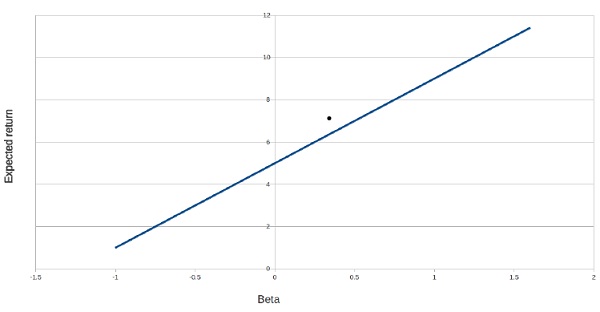

6. You hold the market portfolio. there is a graph plotted Security Market Line (SML) below also plotted an asset, A (the black dot). According to the diagram:

(a) A is overpriced and you should not buy it, but you could short-sell it

(b) A is underpriced and you should buy it

(c) A is correctly priced and you are indifferent between buying and selling it

7. All investors like expected return and hate standard deviation. There are three stocks which are the only risky assets in the world. You have the following information:

Stock Number of shares outstanding Price per share

A 10000 $25

B 20000 $32

Construct the lowest-variance portfolio that has the same expected return as the market portfolio. What is the portfolio you choose?

(a) 1/3 in A, 2/3 in B

(b) .28 in A, .72 in B

(c) .41 in A, .59 in B

(d) Impossible to say, we would need the risk-free rate to tell.

8. There are no taxes. Empanada Mama is a New York-based restaurant chain that is thinking of expanding to California. It is entirely financed with equity, and the beta of its equity is 1. The empanada business is significantly different in California:

Latin American food is much more common and the competition is fierce. There is an empanada chain, called LA Empanada, in Los Angeles, which is financed with $40 of debt and $100 of equity (book values). The debt is risk-free. LA Empanada has 30 shares outstanding, and the current price of its shares is $2. The beta of its equity is 2. What is the beta you will use to calculate the NPV of Empanada Mama's venture in California?

(a) 1

(b) 1.2

(c) 1.43

(d) 2

9. What is the YTM on a 1 year, semiannual payment 10% coupon bond with face value $1000 and price $900?

(a) 5.63%

(b) 10.82%

(c) 21.64%

(d) 22.81%

10. A one-year zero coupon bond has face value $5,000. The issuer may default, and the probability of default is 0.1. In default, the bond pays nothing. Instruments of similar risk pay 6% (e

ective annual). What is the YTM on this bond, expressed as an APR with annual compounding?

(a) 6%

(b) 12%

(c) 13.01%

(d) 17.78%

Answer the following two questions with respect to this information A firm's equity had a book value of $400M last year. ROE is 10% and it retains one-fourth of its earnings. Instruments of the same risk as the equity pay 12%.

11. Assuming it maintains its ROE and payout ratios, what is the expected total dividend next year in $M?

(a) 10

(b) 10.25

(c) 30

(d) 30.75

12. What should the market value of the equity be?

(a) $323.68M

(b) $315.79M

(c) $256.25M

Answer the following four questions with respect to this information There are no taxes or other frictions. Two companies, GOOG and YHOO, have the same assets. They will both last only one period. GOOG is all-equity, but YHOO has zero-coupon risk-free debt with face value $105,000. The companies can have three possible values of EBITDA next year: $105,000, $200,000 and $500,000 with equal probability for each. The beta of the cash flows is 0.6, the risk-free rate is 5% and the market risk premium is 7%. 13. What is the value of GOOG's equity?

(a) 245,726

(b) 191,933

(c) 105,110

14. What is the value of YHOO's debt?

(a) $100,000

(b) $105,000

(c) $90,000

15. What is the value of YHOO's equity?

(a) $100,000

(b) $145,726

(c) $200,116

16. What does the CAPM say the expected return on YHOO's equity should be?

(a) 11.125%

(b) 12.08%

(c) 14.11%

Answer the following three questions with respect to this information Two companies, One and Two, have the same assets, and will make the same EBITDA of $20 for certain each period forever. They have no depreciation. The tax rate is 40%. Company One has perpetual risk-free debt worth $100. The risk-free interest rate is 4%.

17. What is the coupon on Company One's debt?

(a) $10

(b) $4

(c) $5

18. What is the value of Company Two's equity?

(a) $200

(b) $300

(c) $400

19. What is the value of Company One's equity?

(a) $180

(b) $200

(c) $240

(d) $300

20. The tax rate is 0%, and the risk-free interest rate is 10%. Assume all betas are 0. An all-equity financed firm lasts for one period and has a value of $100. It is thinking of changing its capital structure, without changing its assets. If it takes on $50 worth of debt (market value), its equity would be worth $48. This means that the expected value of bankruptcy costs next period is:

(a) $2

(b) $2.2

(c) $4

(d) $5.5