Activity Based Costing

The local accounting firm of Dewey, Cheetum, and Howe has had many profitable years providing financial planning and tax services to retirees. Recent developments in do-it-yourself tax software have begun to erode business and the firm wants to take a closer look at costs. As one of the firm's new hires you have been assigned to prepare an activity based cost analysis with the following data.

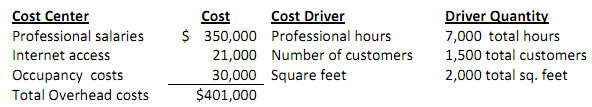

The focus of the analysis is to compare the cost of providing financial planning versus tax preparation services. Your analysis reveals the following about cost centers and their respective drivers:

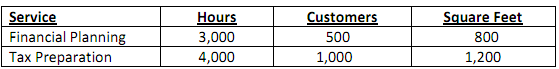

The two main service activities and their related data follow:

Required

1. Compute the cost per cost driver for each of the three cost centers.

2. Use the results from part 1 to allocate costs from each of the three cost centers to both financial planning and tax preparation. Compute total cost and average cost per customer for both financial planning and tax preparation Analysis Component

3. Without providing computations, would the average cost of tax preparation be higher or lower if all center costs were allocated based on the number of customers alone? Explain