Part -1:

Handout Problem

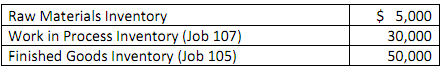

Kramer Manufacturing makes special order products. At March 1, 2013, it had the following inventory balances:

March 2013 transactions:

A. Raw materials purchased on account, $60,000

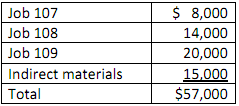

B. Materials requisitioned from the supply room:

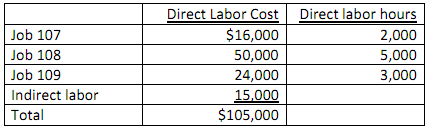

C. Factory labor costs paid in cash were $105,000 for the month of March.

D. Labor costs were assigned as follows:

E. Additional overhead costs during the month:

- Overhead incurred on account, $3,000

- Overhead paid in cash, $4,000

- depreciation on factory assets, $1,000

F. Overhead is applied on the basis of direct labor hours. Annual overhead costs for 2013 are estimated at $320,000 and total direct labor hours are estimated to be 80,000 for 2013. Hint: you need to compute the predetermined overhead rate.

G. During the period, Jobs 107 and Job 109 were completed.

H. Job 105 was sold for $80,000 on account and Job 109 was sold on account for $100,000.

Required:

1. PLEASE NOTE: I suggest printing this problem and the answer sheet and completing it by hand before doing it on the computer. It is much easier to see everything if it is sitting in front of you. This will also allow you to work on this problem without having to sit in front of a computer monitor for a long time.

Once you get the problem completed on paper, you can type your answers into the Excel answer sheet. You will be doing a problem like this on Test #2, so get used to doing this with paper and pencil.

2. Enter the beginning balances in the appropriate ledger accounts and job cost sheets. Remember, job cost sheets constitute the subsidiary ledger for the Goods (Work) in Process Account.

3. Prepare journal entries to record the March 2013 transactions. In the date column, type the transaction letter (A, B, C, etc). There will be something to record for each transaction letter so makes sure you record everything you should. Post your entries to the ledger accounts provided and to the job cost sheets provided. You should probably post after EACH transaction to make sure your account balances are up to date for the next transaction you record. The company does not close any over or under-applied overhead until the end of the fiscal year --- that would be in December 2013- so don't do anything with any under or over applied inventory.

4. Prepare a manufacturing statement for March of 2013. You do not need to include the detail for changes in the raw materials inventory --- you know the amount of direct materials used so you do not have to compute it. We are not going to do anything with under or over applied inventory until December of 2013 so don't do anything about it on this manufacturing statement.

5. Prepare an income statement for the month ending March 31, 2013. Operating expenses are $44,000 and income tax expense is 20% of income before tax.

6. Compute the balances of the inventory accounts and show how they are disclosed in the financial statements.

7. Compute the ending balance of factory overhead. Indicate if this amount is over-applied or under-applied. You don't have to prepare the entry to close the under or overapplied overhead.

Part -2:

Problem #1:

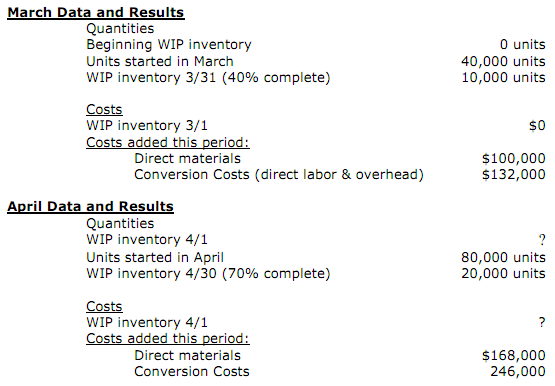

Randolph Company uses a process costing system to account for the manufacture of its only product - the B-Box. There is just one department process to complete the product. The units are started in the Assembly Department. When they are completed in that department they are transferred to finished goods inventory.

Randolph Company uses the FIFO method. Materials are added at the beginning of the process and conversion costs are incurred uniformly throughout the period in both departments.

Information for both departments for March and April is given below:

Required:

1. Prepare a production cost report for the month of March. Use the format shown in the PowerPoint presentation.

2. Prepare a production cost report for the month of April. Use the format shown in the PowerPoint presentation.

Problem #2

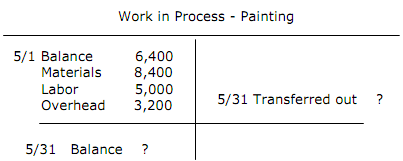

The ledger of Grogan Company has the following work in process account:

Work in Process - Painting

Production records show that there were 800 units in the beginning inventory, 20% complete, 1,200 units started, and 1,500 units transferred out. The units in ending inventory were 60% complete. Materials are entered at the beginning of the painting process.

Instructions:

Answer the following questions (preparing a production cost report will make these questions easier to answer):

1. Complete the Work in Process - Painting t-account as you compute the values asked for below.

2. How many units were actually worked on during the month of May?

3. How many units are in process at May 31?

4. What are the total costs to account for?

5. What is the unit materials cost for May?

6. What is the unit conversion cost for May?

7. What is the total cost of units started in April and finished in May?

8. What is the total cost of units started and finished in May?

9. What is the cost of the May 31 inventory?

10. If all the products completed and transferred out were sold for $17 per unit, what would be the gross profit earned.

11. What would be the gross profit% on the units that were completed and transferred out and then sold for $17 per unit?

Part -3:

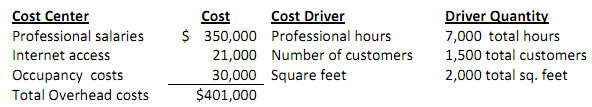

Problem #1- Activity Based Costing

The local accounting firm of Dewey, Cheetum, and Howe has had many profitable years providing financial planning and tax services to retirees. Recent developments in do-it-yourself tax software have begun to erode business and the firm wants to take a closer look at costs. As one of the firm's new hires you have been assigned to prepare an activity based cost analysis with the following data.

The focus of the analysis is to compare the cost of providing financial planning versus tax preparation services. Your analysis reveals the following about cost centers and their respective drivers:

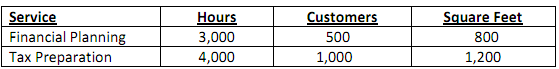

The two main service activities and their related data follow:

Required

1. Compute the cost per cost driver for each of the three cost centers.

2. Use the results from part 1 to allocate costs from each of the three cost centers to both financial planning and tax preparation. Compute total cost and average cost per customer for both financial planning and tax preparation Analysis Component

3. Without providing computations, would the average cost of tax preparation be higher or lower if all center costs were allocated based on the number of customers alone? Explain

Problem #2 - Allocating Joint Costs

Windsboro Properties is developing a subdivision that includes 400 home lots. The 300 lots in the Canyon section are below a ridge and do not have view of the neighboring canyons and hill; the 100 lots in the Hilltop section offer unobstructed views.

The expected selling price for each Canyon lot is $50,000 and for each Hilltop lot is $90,000. The developer acquired the land for $5,000,000 and spent another $2,000,000 on street and utilities improvements.

Required:

1. Assign the joint land and improvement costs to the lots using the value basis of allocation.

2. Compute the average cost per lot in the Canyon section and in the Hilltop section.

3. Compute the average gross profit realized on the sales of Canyon lots and the Hilltop lots.

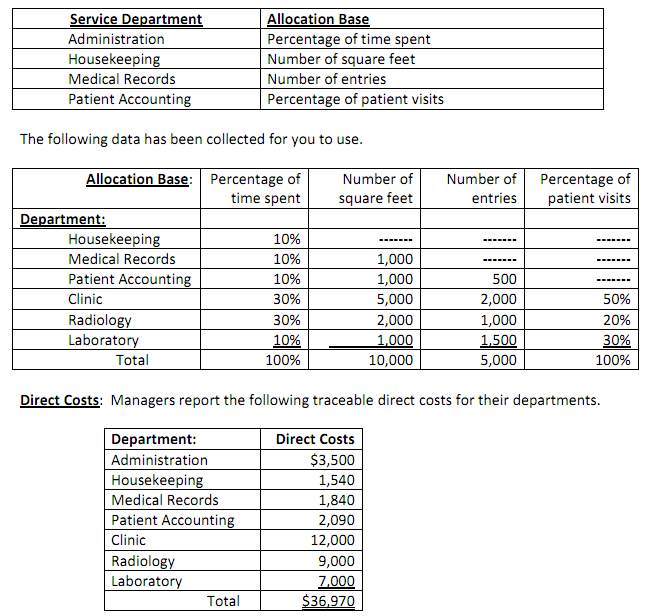

Problem #3- Departmental Expense allocations

Before completing this problem, make sure you have read and studied the Department Expense allocation illustration handout and the demo problem handout. It will really help you out on this problem.

The Live Oak Clinic is a rural health clinic with four service centers and three profit centers. In order of utilization, the service centers are Administration, Housekeeping, Medical Records and Patient Accounting. The three profit centers are Clinic, Radiology, and Laboratory.

Allocation bases for service department costs are:

Indirect Costs: The business incurred indirect costs that benefited for the entire facility totaling $2,000. The costs are to be allocated to the departments in the following ratio: 1:1:1:1:2:2:2. (1 part each for the service departments and 2 parts each for the operating departments for a total of 10 parts)

Instructions

The clinic's administrators have asked you to prepare departmental income statement for the clinic. (See exhibit 21.21 in your book).

1. To complete this task, you must first prepare the cost allocations for the expenses of the service departments to the other service departments and operating departments by completing the cost allocation spreadsheet on the answer sheet.

- I have included supporting schedules for you to use to compute the allocation of service department expenses. When allocating the service department costs, start with the administration costs - those costs are allocated to all the other departments.

Calculate new total costs for housekeeping then allocate those housekeeping costs to the remaining departments (not administration) etc.

- When you have successfully completed the allocations, only the 3 operating departments should have costs - the service departments' costs should have been totally allocated. Keep this in mind: you don't allocate costs to yourself. In other words, no particular service department costs will be allocated back to that department.

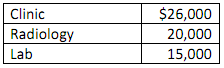

2. Services provided and billed to patients for each of the departments were:

- Prepare the departmental Income Statement for Live Oak Clinic for the month ended March 31, 2011. (Think about this before you totally copy Exhibit 21.21. That exhibit is for a store that sells merchandise. This problem is for a health clinic that provides services only so there is no "cost of goods sold" reported on the income statement.