Objectives:

The objectives of this project are for students to demonstrate:

1. Skills and knowledge in the preparation of manual financial statements that comply with Generally Accepted Accounting Practice

2. Incorporate use of a computerised accounting package

3. Compare and reconcile the manual and computerised financial statements

Part A:

Part A requires you to complete the requirements set out in the manual financial accounting task that follows. It is to be expected that you will demonstrate a comprehensive understanding of relevant concepts, principles and practice in the manual preparation and presentation of financial statements. Journal, ledger and an Excel worksheet template for this problem are available under the assignment folder in the assessment section on Blackboard.

Excel Quiz Question Examples & Answers (no number formats used)

1. What is the total sales revenue for the month of April?

2. What is the total of the non-current assets as at 31 March on the Comparative Statement of Financial Position?

3. What Posting Reference appears below the total of the “Other Accounts” column in the Cash Payments Journal?

4. What is the amount of the credit posting in the accounts receivable general ledger account on 30 April?

5. What is the balance of the accounts receivable general ledger account on 30 April?

6. How much did Snowy Resort owe to Active Sports as at 26 April?

Part B: Reckon Software

Part B requires you to complete the requirements set out in the computerised financial accounting task that follows. It is to be expected that you will demonstrate a comprehensive understanding of relevant concepts, using Reckon software. Demonstration videos, exercises and other supporting materials are available under Learning Resources/ Reckon Software Materials on Blackboard.

Part C: Reconciliation of Manual and Reckon Accounting Task

Part C requires you to critically evaluate Excel and Reckon reports to initially identify any differences and ultimately to reconcile to each other.

PART A:

BACKGROUND AND FACTS:

Lauren Flintoff is the owner of Active Sports, a retail sports equipment business located in Milton. She established the business 3 years ago and operates as a sole trader. Lauren submits the Business Activity Statements (GST Return) quarterly on an accruals basis.

Lauren is currently using a manual system to prepare the financial records. She has come to you to implement Reckon software. To ensure the accuracy of the software implementation, she has asked you to prepare both manual records and records in Reckon for the month ending 30 April 2016.

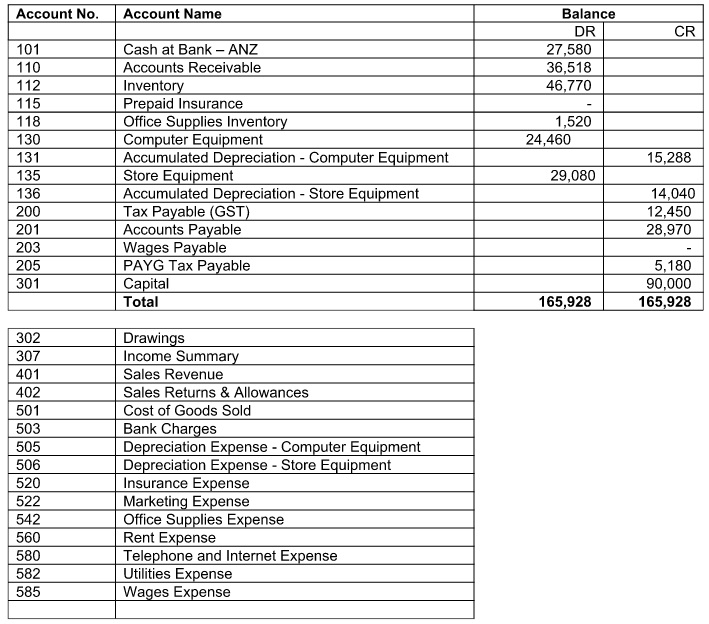

Refer to Chart of Accounts below when preparing journals for the account numbers and names used.

Chart of Accounts and Trial Balance as at 31 March, 2016

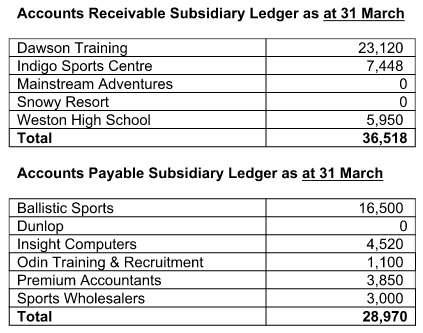

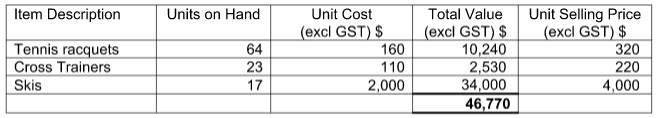

Inventory Balances as at 31 March

Inventory Balances as at 31 March

Active Sports sells three types of inventory and uses a perpetual inventory system. The stock take at 31 March showed:

Cost price of inventory items remains constant for the month and thus the inventory cost flow method is irrelevant for this assignment.

Accounting Information:

The business uses the following specialised journals to record its business transactions:

A) A Sales Journal is used to record the sale of inventory on credit during the month (not sales returns).

B) A Cash Receipts Journal is used to record all cash received.

C) A Cash Payments Journal is used to record all cash paid.

D) A Purchases Journal is used to record all purchases of inventory on credit (not purchase returns).

E) A General Journal is used to record all other transactions. All invoices received for expenses incurred and owing are recorded in the general journal at the time of receiving the invoice.

(Narrations are not required for general journal transactions.)

The business uses a general ledger, an accounts receivable subsidiary ledger and an accounts payable subsidiary ledger. The 4 column running balance form of ledger account is used.

The business does use a Sales Returns and Allowances account in the current manual system to record sales returns from customers. Note that there is no ability in our Reckon student version software to record Sales Returns separately. Instead the software will process a sales return as a reduction from Sales Revenue. Do not create a separate Sales Returns account in Reckon.

NOTE: There is an extra column in the ledger accounts to make a note of source document numbers etc. We do not have such information so leave this column blank.

Financial statements are prepared at the end of each month. The accounts are also closed off at the end of each month.

An Excel template is available on the Blackboard site and is to be used to complete the manual accounting task. Reckon software is to be used to prepare computerised records in Part B to ensure they agree for Part C.

The business transactions that occurred in April 2016 are as follows: (refer chart of accounts for account names and numbers. Do not make up your own account names).

1. April 1 Paid rent for April $4,400 with cheque number 46 (including GST $400).

2. April 1 Purchased an Apple MacBook Pro on credit from Insight Computers for $1,342 (including GST $122)

3. April 2 Purchased office supplies with cheque number 47 for $770 (including GST $70)

4. April 2 Sold 5 pairs of skis on credit to Snowy Resort, invoice number AB32 $22,000 (including GST $2,000).

5. April 3 Purchased 40 tennis racquets on credit from Dunlop $ 7,040 (including GST $640).

6. April 4 Paid for prepaid insurance of $1,320 for 12 months effective 1 April (including GST $120) with cheque number 48.

7. April 4 Sold 23 pairs of cross trainers, 6 tennis racquets and 1 pair of skis as a cash sale for $12,078 (including GST $1,098) (Choose Deposit to ANZ Bank Account in Reckon).

8. April 4 Lauren withdrew $8, 000 cash for her personal use with cheque number 49 (no GST applicable.)

9. April 4 Paid the monthly net wages of the staff of $10,400 with cheque number 50 (no GST applicable.)

10. April 10 Sold 4 pairs skis and 20 tennis racquets on credit to Mainstream Adventures, Invoice Number AB33 $24,640 (including GST $2,240).

11. April 11 Purchased 50 pairs of cross trainers and 5 pairs of skis on credit from Sports Wholesalers $17,050 (including GST $1,550).

12. April 14 Paid Premium Accountants the balance owing of $3,850 with cheque number 51.

13. April 21 Paid Ballistic Sports $15,400 with cheque number 52 as part payment of prior month purchases of inventory.

14. April 21 Issued a credit note to Mainstream Adventures for return of 2 tennis racquets, Credit Number 14 $704 ($640 plus GST $64). (Retain as an available credit in Reckon).

15. April 22 Received $15,200 from Dawson Training as payment on account. (Choose Deposit to ANZ Bank Account in Reckon).

16. April 26 Paid the monthly telephone and internet expense with cheque number 53 for $275 (including GST $25).

17. April 26 Invoiced Dawson Training for 40 tennis racquets, Invoice Number AB34 for $14,080 (including GST $1,280).

18. April 28 Received $6,000 on account from Indigo Sports Centre.

19. April 28 Returned 5 pairs of cross trainers to Sports Wholesalers and received a credit of $ 605 (including GST $55).

20. April 30 Lauren lodged her quarterly Business Activity Statement (BAS return) and paid cheque number 54 to the ATO for a total of $17,630. This represented the March quarter Tax Payable (GST) of $12,450 and also the previous month PAYG tax payable of $5,180. (Record each item on a separate line in Excel). (Use Write Cheques function in Reckon).

21. April 30 Received $22,000 from Snowy Resort as payment on account.

22. April 30 Paid the marketing expenses for April with cheque number 55 for $814 (including GST $74).

23. April 30 Paid for utilities expense for April with cheque number 56 for $616 (including GST $56).

24. April 30 Bank Statement: Paid bank charges of $25 (no GST applicable). (Use Write Cheques function in Reckon)

25. April 30 Record a general journal entry for $2,590 for the total PAYG tax withheld on the monthly wages. (Debit wages expense and credit PAYG Tax Payable). (PAYG tax payable is tax withheld from staff wages owed to the government.)

26. April 30 Lauren contributed $2,500 of capital into the business bank account.

EXCEL CHECK VALUES TO ASSIST YOU TO COMPLETE THE SET ACCURATELY:

Total of the Unadjusted Trial Balance Columns of the Worksheet $228,697

Total of the Adjustments Columns of the Worksheet $6,288

Total of the Adjusted Trial Balance Columns of the Worksheet $233,035

Net profit for April $7,917

Part B: Reckon Accounting Task Instructions

Before Starting Reckon Component:

It is vital that you complete the 2 Essential Reckon exercises for your Assignment under Learning Resources/ Reckon Support Materials before you start the Reckon component of this assignment otherwise you may waste significant amounts of time.

Reckon software is to be used to prepare computerised records in Part B to ensure they agree with the manual records. It is important to save and backup regularly to your QUT student network drive or other secure location rather than relying on a USB or to the local drives of QUT computers which are cleared as users log off. Do not rely on one file location in case there is a problem such as corruption, losing USB etc.

Reckon will name your original files with the extension. QBW and the backup files .QBB.Marks will be allocated, where students have produced correct reports that reconcile to the required values. Remember, key figures such as profit are provided and the client is expecting you to ensure Excel and Reckon agree. If they don't agree or you don’t allow enough time and only achieve the initial set up process, low marks will result because you haven't achieved assessment or client requirements.

1) Establish a new data base in Reckon.

Step 1 Company Information. On the Reckon menu bar, click File > New company. Click Start Interview

Enter Company Name and add your student number and surname and to the end of the company name. (eg Active Sports 9084574 Marsland). Leave other fields blank.

Note: Click Next at each step of the interview to move on.

Step 2: Select your industry. Select Product Sales/Retail

Step 3: How is your company organised? Select Individual Tax Return

Step 4: Select the first month of your financial year. Select: July

Step 5: Ignore passwords

Step 6: Create your company file, indicating a directory to save to. Click Save.

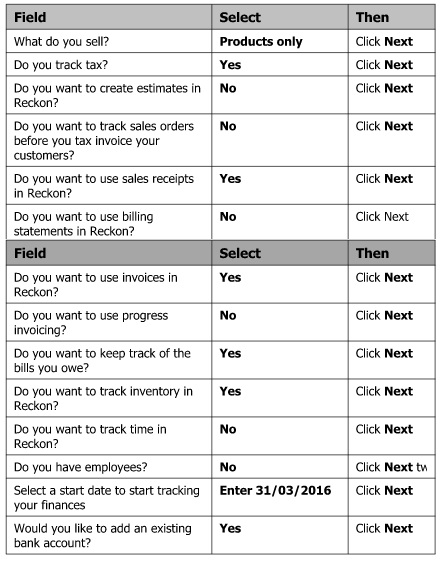

Step 7: Customising

In the interview process, choose the Preferences below. Take care to enter carefully as you can’t change these preferences and would otherwise need to start again:

Key in ANZ Bank Account for the name of the bank account. Click on or after 31/03/2016. Click Next three times. Click Finish to complete the initial set up process.

2) Set up preferences for banking for all receipts and payments to process to the ANZ Bank Account (otherwise they will default to Undeposited Funds).

3) Important: Set up user for Audit Trail Log to enable production of an Audit Trail Report.

Click on Company. Click on Set Up Users. Click on Add User.

Enter your student number followed by your surname (eg 9084574 Marsland). Record exactly what you have typed safely as you will use it to log in and record all of the assignment transactions.

Do not enter Passwords. Click Next Click No that you do not want to enter a password.

Click on All Areas of Reckon Accounts (for the user to enable access).

Click Yes to confirm that you do wish to allow the user to access all areas of Reckon. Click Finish.

Click Close.

4) Choose the option File/ Close Company/(Log Off and Open the Active Sports.QBW File that you have established. Now log into Reckon using the User Name that you established earlier.

(if you forget your username, log in as Admin and note down the user name and repeat the log in process).The Administration User is not to be used in any of the assignment process, otherwise you will receive 0 for the Reckon component.

Set up lists and Opening Balances for Inventory, Customers and Suppliers as at 31 March 2016. (Addresses are not required for this project for customers or suppliers).

5) Run an Audit Trail Report as at 31 March 2016 to ensure that you can see your User Name in all the transactions (not the Admin user). If you fail to submit an Audit Trail Report or submit an Audit Trail with the Admin user only recorded, you will receive 0 for the Reckon component.

6) Enter opening balances for all other accounts as at 31 March 2016.

7) Run a trial balance as at 31 March 2016 to ensure all opening balances are accurately entered. Process a general journal entry to correct the items in the trial balance which require adjustment including processing a general journal entry to correct Uncategorised income, Uncategorised expenses and Opening Balance (equity).

8) Save your file. Also, backup your Reckon file using the Save Copy or Backup function (which will name it with the extension.QBB).

9) Record the April transactions in Reckon, opening new accounts as necessary. For Reckon, you do not need to use the account numbers provided in the Chart of Accounts.

10) Prepare a trial balance as at 30 April 2016 and ensure all account values agree to the unadjusted manual trial balance prepared in Part A except for Sales and Sales Returns. (Reckon Trial Balance total should be $228,057 as Sales Returns is netted off against Sales in Reckon not displayed separately as it is in Excel).

Note that there is no ability in our Reckon student version software to record Sales Returns separately. Instead the software will process a sales return as a reduction from Sales Revenue. Do not create a separate Sales Returns account in Reckon.

11) Process the adjusting entries above in Reckon.

12) Print to pdf the following reports from Reckon. Combine into 1 pdf if possible for ease of marking.

Part C Reckon Accounting Task Instructions:

Ensure all reports agree with manual reports generated in Part A (except for different treatment of Sales Returns in Reckon as Sales Returns is netted off Sales in Reckon not displayed separately as it is in Excel.)

Note that there will be minor differences in the naming used in Reckon (eg Trade Receivables, Trade Creditors and Tax Payable have equivalent names to the Excel Chart of Accounts and don’t need to be altered).

Similarly, the order of accounts must be logical and in the correct categories within Current Assets, Fixed Assets, Current Liabilities and Equity. Ensure that the Balance Sheet displays Original Cost of Fixed Assets above Accumulated Depreciation and that Capital displays above Drawings. (These can be altered in the Chart of Accounts as demonstrated in the sample exercises).

In Reckon, there is no need to remove accounts with a zero balance as they are fine to leave as they are.

For Reckon, you do not need to use the account numbers provided in the chart of accounts. Specifically, check the following four items to ensure they are the same in both Excel and in Reckon:

- Gross Profit

- Net Income or Net Profit

- Total Assets

- Total Equity

Attachment:- 2016 Active Sports Assignment Template(1).xlsx