Exercise 1

Classify each of the following transactions as an operating activity, an investing activity or a financing activity cash flow, or a non cash transaction - Indicate also its effect on the Income statement (increase or decrease the profit)

- Provide services for cash

- Purchase marketable securities for cash

- Paid cash for rent

- Received interest on note receivable

- Paid cash for salaries

- Received advance payment for services

- Paid a cash dividend

- Provide services on account

- Bought land with cash

- Collected cash from receivables

- Issued common stock for cash

- Repaid principal and interest on a note payable

- Declared a stock split

- Purchased inventory with cash

- Recorded depreciation of fixed asset

- Paid insurance with cash

- Issued a note payable in exchange for equipment

Exercise 2

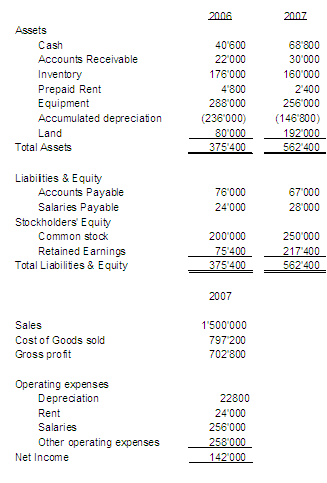

Prepare the statement of Cash flows for 2007, using the indirect method, with the financial statements and additional information as below:

Additional information

- Purchased land for $ 112,000

- Purchased new equipment for $ 100,000

- Sold old equipment that costs $ 132,000 with accumulated depreciation of $ 112,000 for 20,000 cash

- Issued common stock for $ 50,000