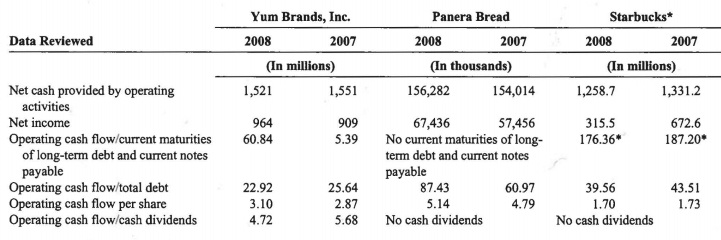

Assignment: With this case, we review the cash flow of several restaurant companies. The restaurant companies reviewed and the year-end dates are as follows:

1. Yum Brands, Inc.

(December 30, 2008; December 30, 2007)

"Through the five concepts ofKFC, Pizza Hut, Taco Bell, LJS and A & W (the "Concepts") the company develops, operates, franchises and licenses a world system of restaurants which prepare, package and sell a menu of competitively priced food items." 1 0-K

2. Panera Bread

(December 30, 2008; December 25, 2007)

"As of December 30, 2008, Panera operated and through franchise agreements with 39 franchisee groups, 1,252 cafes." 1 0-K

3. Starbucks

(September 28, 2008; September 30, 2007)

"Starbucks Corporation was formed in 1985 and today is the world's leading roaster and retailer of specialty coffee." 1 0-K '

Required to do:

Q1. Comment on the difference between net cash provided by operating activities and net income. Speculate on which number is likely to be the better indicator of long-term profitability.

Q2. Comment on the data reviewed for each firm.

Q3. Do any of these firms appear to have a cash flow problem? Comment.