Trinco Ltd:

Introduction:

Trinco Ltd (Trinidad and Tobago-T&T) has been negotiating a contract with a potential customer in Jamaica. Before the negotiations began the Jamaican company agreed to pay $10,000 in advance to cover the expenditures of Trinco. Such expenses were to cover the costs of sending out technical staff to Jamaica. This is the first export order the company has received since 1988. Unfortunately, the prior export orders were not profitable and managers decided the best strategy was to concentrate on business in T&T.

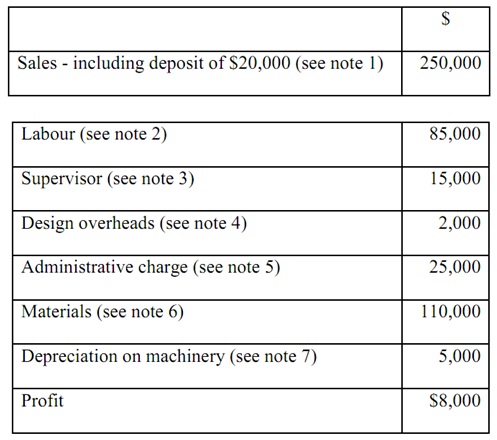

The sales department has prepared a statement exhibiting that the contract will make a profit. It is normal for the sales department to make cost estimates as they have a lot of experience of this type of work.

Occasionally the management accountant will as well be asked to comment on the estimates prepared by the sales department. As this order is different and might lead to a lot more business in the future the senior managers asked the management accountant to comment on the statement, illustrated below.

Statement prepared by sales department:

After her investigation the management accountant prepared a short report. The major points are summarized below.

Comments from management accountant:

Note 1: The deposit will not have to be refunded.

Note 2: The labor costs comprise $15,000 of costs for work that has already been incurred. This is the cost of sending engineers to Jamaica to help with the negotiations.

Note 3: This is 50% of the cost of a supervisor. It is predicted that the supervisor will spend about half his time on the contract. This cost doesn’t comprise a $2,000 bonus for the supervisor if the contract is completed on time.

Note 4: Such costs have already been incurred.

Note 5: This charge is equivalent to 10% of sales. This is levied on all contracts to cover general administrative costs.

Note 6: Materials

40,000kg of material X at $1.5 per kg = $60,000

20,000kg of material Y at $2.50 per kg = $50,000

Material X is employed regularly by the company. There is 20,000 kg in stock however the market price has just raised to $2 per kg.

Material Y is never used by the company. There is 30,000 kg in stock that cost $2.50 per kg. To buy it now would cost $4 per kg. An alternative choice for the company is to sell it for scrap at $2.10 per kg.

Note 7: Depreciation has been computed at $5,000. Though the management accountant discovers that this charge is for a machine that is presently not used. The management accountant has received an offer of $100,000 for the machine now but if the project goes ahead it will only be sold for $50,000 at the end of the project.

Additional information:

The statement above doesn’t comprise the cost of additional training if the contract goes ahead. The cost of the training has been estimated at $10,000.

Question 1:

Advise managers whether or not this contract is profitable. All suppositions should be clearly stated.

Question 2:

Recognize and assess any additional information that managers require to consider before accepting or rejecting this contract.