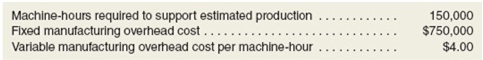

Calculating Predetermined Overhead Rates and Job Costs Kody Corporation employs a job-order costing system with a plant wide overhead rate based on the machine-hours. At the starting of the year, the company made the following estimates:

Required:

1. Calculate the predetermined overhead rate.

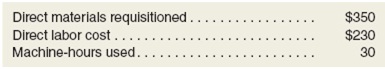

2. Throughout the year Job 500 was completed and started. The following information was accessible with respect to this job:

Calculate the total manufacturing cost assigned to Job 500.

3. Throughout the year the company worked a total of 147,000 machine-hours on all jobs and acquired real manufacturing overhead costs of $1,325,000. What the amount is of under applied or over applied overhead for year? If this amount were closed out completely to Cost of Goods Sold, would the journal entry raise or reduce net operating income?

Applying Overhead; Cost of Goods Manufactured

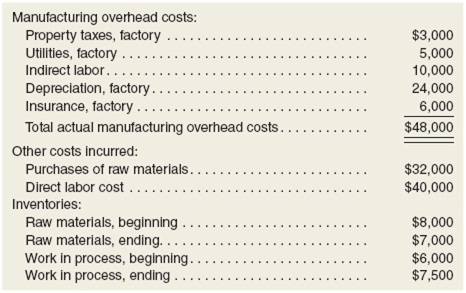

The following cost data relate to manufacturing activities of Black Company throughout the just ended year:

The company uses a predetermined overhead rate to apply overhead cost to the jobs. The rate for the year was $5 per machine-hour; a total of 10,000 machine-hours were recorded for year. All raw materials ultimately become direct materials—none are classified as indirect materials.

Required:

1. Calculate the amount of under applied or over applied overhead cost for year.

2. Make a schedule of cost of goods manufactured for the year.

Departmental Overhead Rates

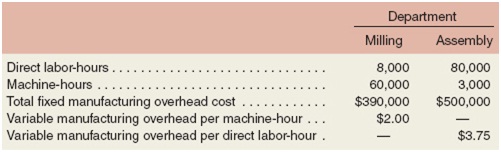

Diewold Company has two departments, Assembly and Milling. The company employs a job-order costing system and computes a predetermined overhead rate in each department. The Milling Department bases its rate on the machine-hours, and the Assembly Department bases its rate on direct labour-hours. At the starting of the year, the company made the following estimates:

Required:

1. Calculate the predetermined overhead rate to be employed in each department.

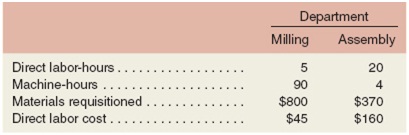

2. Suppose that the overhead rates you computed in (1) above are in effect. The job cost sheet for Job 407 that was started and completed throughout the year, showed the following:

Calculate the total manufacturing cost assigned to Job 407.

3. Would you anticipate substantially different amounts of overhead cost to be charged to some jobs if the company employed a plant wide overhead rate based on direct labour-hours instead of using departmental rates? Elucidate.