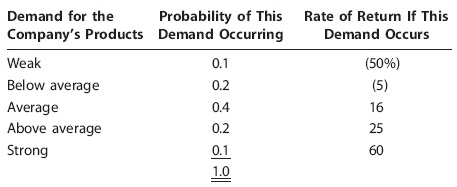

Problem 1: EXPECTED RETURN A stock's returns have the following distribution:

Calculate the stock's expected return, standard deviation, and coefficient of variation.

Problem 2: REQUIRED RATE OF RETURN Assume that the risk-free rate is 6% and the expected return on the market is 13%. What is the required rate of return on a stock with a beta of 0.7?

Problem 3: BETA AND REQUIRED RATE OF RETURN A stock has a required return of 11%, the risk-free rate is 7%, and the market risk premium is 4%.

a. What is the stock's beta?

b. If the market risk premium increased to 6%, what would happen to the stock's required rate of return? Assume that the risk-free rate and the beta remain unchanged.

Problem 4: PORTFOLIO REQUIRED RETURN Suppose you are the money manager of a $4 million investment fund. The fund consists of four stocks with the following investments and betas:

Stock Investment Beta

A $400,000 1.50

B 600,000 0.50

C 1,000,000 1.25

D 2,000,000 0.75

If the market's required rate of return is 14% and the risk-free rate is 6%, what is the fund's required rate of return?

Problem 5: CAPM AND REQUIRED RETURN Calculate the required rate of return for Manning Enterprises assuming that investors expect a 3.5% rate of inflation in the future. The real risk-free rate is 2.5%, and the market risk premium is 6.5%. Manning has a beta of 1.7, and its realized rate of return has averaged 13.5% over the past 5 years.