Assignment: Present and Future Value

Now consider an irregular cash flow stream (where CFs can take on any value).

Question 1: Calculate the Present Value of the Uneven Cash Flows. Interest Rate = 10%

|

T=0

|

T=1

|

T=2

|

T=3

|

T=4

|

T=5

|

|

$0

|

$100

|

$300

|

$300

|

$300

|

$500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Question 2: Calculate the Future Value of the Uneven Cash Flows.Interest Rate = 12%

|

T=0

|

T=1

|

T=2

|

T=3

|

T=4

|

T=5

|

|

$0

|

$100

|

$300

|

$300

|

$300

|

$500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

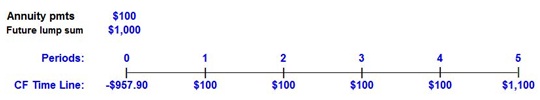

Question 3: Assume that an investment with the following positive cash flows has a cost of $957.90 (outflow). Find the rate of return on this investment.

Question 4: How many years does it take for an investment to double if the interest rate is 1.25%?