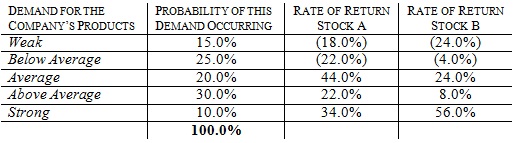

PROBLEM 1: The returns of Stock A and Stock B have the following distribution:

a) Calculate the Expected Return for Stock A and Stock B

b) Calculate the Variance and the Standard Deviation for Stock A and Stock B

c) Calculate the Coefficient of Variation of each stock

d) Calculate the Correlation Coefficient between Stock A and Stock B

e) In which of the two stocks would you invest your money? Explain.

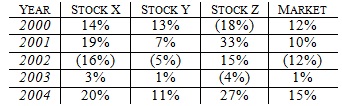

PROBLEM 2: You have observed the following returns over time:

a) What are the betas of Stocks X, Y and Z?

b) What are the required rates of return for Stocks X, Y and Z?

c) What are the standard deviations for Stocks X, Y and Z?

d) What is the required rate of return and standard deviation for a portfolio consisting of 20% invested in Stock X, 45% invested in Stock Y, and 35% invested in Stock Z?

e) If Stock X’s expected return is 22%, is Stock X under-or-over valued?