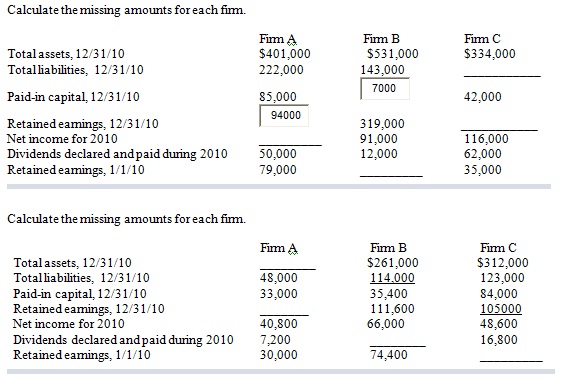

Task: Asset and Liability problems:

The information presented here represents selected data from the December 31, 2010, balance sheets and income statements for the year then ended for three firms.

Gary's TV had the following accounts and amounts in its financial statements on December 31, 2010. Assume that all balance sheet items reflect account balances at December 31, 2010, and that all income statement items reflect activities that occurred during the year then ended.

Interest expense $9,000

Paid-in capital 80,000

Accumulated depreciation 6,000

Notes payable (long-term) 280,000

Rent expense 16,000

Merchandise inventory 164,000

Accounts receivable 48,000

Depreciation expense 3,000

Land 35,000

Retained earnings 225,000

Cash 36,000

Cost of goods sold 394,000

Equipment 18,000

Income tax expense 60,000

Accounts payable 26,000

Sales revenue 620,000

(b) Calculate the total assets at December 31, 2010.

(c) Calculate the earnings from operations (operating income) for the year ended December 31, 2010.

(d) Calculate the net income (or loss) for the year ended December 31, 2010.

(d) Calculate the net income (or loss) for the year ended December 31, 2010.

(f) If $129,000 of dividends had been declared and paid during the year, what was the January 1, 2010, balance of retained earnings?