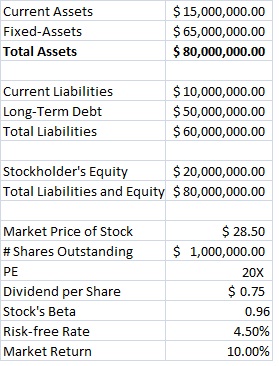

Question 1: Apply the residual income model to determine the intrinsic value of the stock for a firm with the financial data shown in this table.

Question 2: Calculate the correlation between Stock A and Stock B.

Stock A Stock B Market

Beta 1.07 0.75 1.00

Yield 12.05% 9.85% 11.35%

Std Dev 15.64% 12.63% 14.11%

Question 3: A stock just paid a dividend of $2.00. Due to the introduction of a proprietary product, the dividend growth rate is expected to be 30 percent for the next two years, 15 percent for years 3 and 4, and then return to a constant growth rate assumption of 4 percent thereafter. The required return on the stock is 18 percent. Calculate the current expected price of the stock.