Problem 1: Given illustrative data (provided by the instructor) for a company selling its output in a foreign country, calculate effects of an appreciation and a depreciation in the exchange rate on the price of its output in that country and the likely effects on the demand for its output.

Problem 2: For a company sourcing key inputs in a foreign country, calculate effects of an appreciation and depreciation in the exchange rate on its input prices and the likely effects on the company's cost of production.

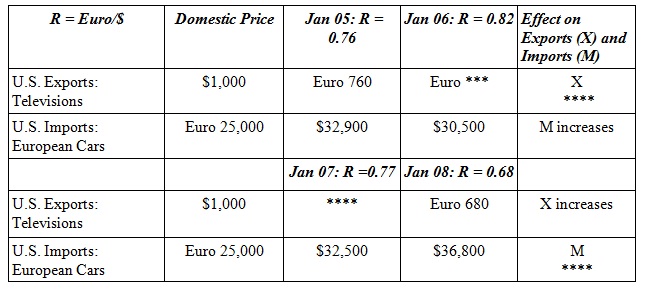

Table: Effect of Dollar Appreciation and Depreciation on U.S. Exports and Imports

Many would argue that when the US Dollar is appreciated, export decreases, when the US Dollar depreciates, export increased. Since GDP = consumption + investment + government spending + net export, can a devaluation of the dollar, improve US GDP and provide economic growth? Based on your observation, is that statement true and why? Explain and justify your claims.