Assignment:

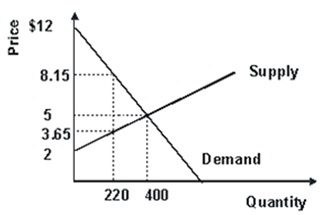

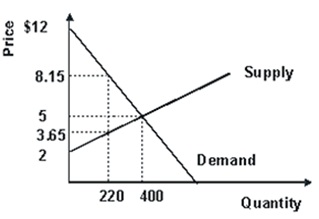

Question 1 Calculate consumer surplus for the market in equilibrium above. (Note: to calculate the area of a right triangle, multiply the base times the height, then divide the product by 2. Give your answer as a whole number.)

Question 2 Calculate producer surplus for the market in equilibrium above. (Give your answer as a whole number)

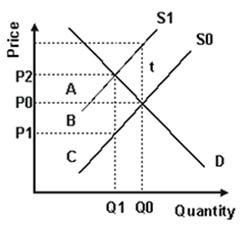

Question 3 Refer to the graph above. Given a tax of t on suppliers, revenue collected by the government is

A. A and B. Suppliers pay A. Consumers pay B

B. A, B, C. Suppliers pay A and B. Consumers pay C

C. A, B, C. Suppliers pay B and C. Consumers pay A

D. A and B. Suppliers pay B. Consumers pay A

Question 4 According to the standard market model and neoclassical welfare analysis, a tax levied against a consumer good will necessarily come mostly out of consumer surplus if...

A. Consumer are directly responsible for paying the tax

B. Demand is relatively elastic

C. Demand is relatively inelastic

D. Producers are directly responsible for paying the tax

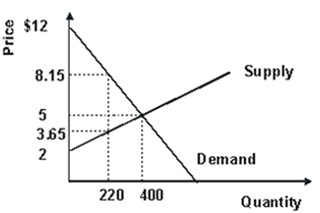

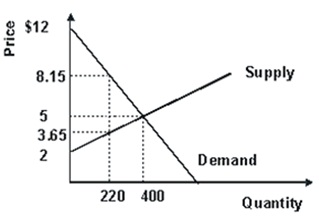

Question 5. In the market depicted above, suppose a price floor holds the price at $8.15. Calculate consumer surplus for this situation.

Question 6 In the market depicted above, suppose a price floor holds the price at $8.15. Calculate producer surplus for this situation.

Question 7 In the market depicted above, suppose a price floor holds the price at $8.15. Calculate deadweight loss for this situation.

Question 8 What English economist likened supply and demand to the blades of a pair of scissors?