1. Gulf Consulting Co. reported the following on its December 31, 2011, balance sheet:

Equipment (at cost) . . .$700,000

In a disclosure note, Gulf indicates that it uses straight-line depreciation over five years and estimates salvage value as 10% of cost. Gulf's equipment averages 3.5 years at December 31, 2011.

What is the book value of Gulf's equipment at December 31, 2011?

A. $259,000

B. $490,000

C. $441,000

D. $210,000

2. Broadway Ltd. purchased equipment on 1/1/09 for $800,000, estimating a five-year useful life and no residual value. In 2009 and 2010, Broadway depreciated the asset using the straight-line method. In 2011, Broadway changed to sum-of-years'-digits depreciation for this equipment. What depreciation would Broadway record for the year 2011 on this equipment?

A. $120,000.

B. $240,000.

C. $160,000.

D. $200,000.

3. Axcel Software began a new development project in 2010. The project reached technological feasibility on June 30, 2011 and was available for release to customers at the beginning of 2012. Development costs incurred prior to June 30, 2011 were $3,200,000 and costs incurred from June 30 to the product release date were $1,400,000. 2012 revenues from the sale of the new software were $4,000,000 and the company anticipates additional revenues of $6,000,000. The economic life of the software is estimated at four years. 2012 amortization of the software development costs would be

A. $350,000.

B. $0.

C. $1,840,000.

D. $560,000.

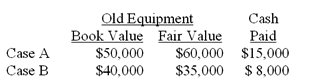

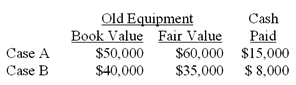

4. Below are data relative to an exchange of similar assets by Grand Forks Corp. Assume the exchange has commercial substance.

In Case B, Grand Forks would record a gain/(loss) of

A. $3,000.

B. $(5,000).

C. $(3,000).

D. $5,000.

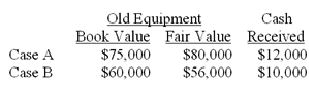

5. Below are listed data relative to an exchange of equipment by Pensacola Inc. Assume the exchange has commercial substance.

In Case B, Pensacola would record a gain/(loss) of:

A. $(10,000).

B. $(4,000).

C. $0.

D. $4,000.

6. Below are listed data relative to an exchange of equipment by Pensacola Inc. Assume the exchange has commercial substance.

In Case A, Pensacola would record the new equipment at:

A. $68,000.

B. $80,000.

C. $67,250.

D. $63,750.

7. Robertson Inc. prepares its financial statements according to International Financial Reporting Standards. At the end of its 2011 fiscal year, the company chooses to revalue its equipment. The equipment cost $540,000, had accumulated depreciation of $240,000 at the end of the year after recording annual depreciation, and had a fair value of $330,000. After the revaluation, the accumulated depreciation account will have a balance of

A. $270,000.

B. $264,000.

C. $330,000.

D. $240,000.

8. Rice Industries owns a manufacturing plant in a foreign country. Political unrest in the country indicates that Rice should investigate for possible impairment. Below are data related to the plant's assets ($ in millions):

|

Book value

|

$190

|

|

Undiscounted sum of future estimated cash flows

|

210

|

|

Present value of future cash flows

|

175

|

|

Fair value less cost to sell (determined by appraisal)

|

180

|

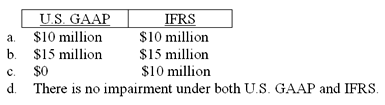

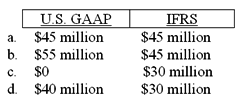

The amount of impairment loss that Rice should recognize according to U.S. GAAP and IFRS, respectively, is

A. Option b

B. Option c

C. Option d

D. Option a

9. An asset acquired January 1, 2011, for $15,000 with an estimated 10-year life and no residual value is being depreciated in an equipment group asset account that has an average service life of eight years. The asset is sold on December 31, 2012, for $6,000. The entry to record the sale would be

|

a. Cash 6,000

|

|

Loss on sale of equipment 9,000

|

|

Equipment

|

15,000

|

|

b. Cash 6,000

|

|

|

Equipment

|

6,000

|

|

c. Cash 6,000

|

|

|

Accumulated depreciation 3,750

|

|

|

Loss on sale of equipment 5,250

|

|

|

Equipment

|

15,000

|

|

d. Cash 6,000

|

|

|

Accumulated depreciation 9,000

|

|

|

Equipment

|

15,000

|

A. Option c

B. Option a

C. Option d

D. Option b

10. Murgatroyd Co. purchased equipment on 1/1/09 for $500,000, estimating a four-year useful life and no residual value. In 2009 and 2010, Murgatroyd depreciated the asset using the sum-of-years'-digits method. In 2011, Murgatroyd changed to straight-line depreciation for this equipment. What depreciation would Murgatroyd record for the year 2011 on this equipment?

A. $125,000

B. $350,000

C. $150,000

D. $75,000

11. Jennings Advertising, Inc., reported the following in its December 31, 2011, balance sheet:

|

Equipment

|

$500,000

|

|

Less: Accumulated depreciation-equipment

|

$135,000

|

In a disclosure note, Jennings indicates that it uses straight-line depreciation over 10 years and estimates salvage value at 10% of cost. What is the average age of the equipment owned by Jennings?

A. 7.3 years

B. 2.7 years

C. 3 years

D. 7 years

12. Cantor Corporation acquired a manufacturing facility on four acres of land for a lump-sum price of $8,000,000. The building included used but functional equipment. According to independent appraisals, the fair values were $4,500,000, $3,000,000, and $2,500,000 for the building, land, and equipment, respectively. The initial values of the building, land, and equipment would be

|

Building

|

Land

|

Equipment

|

|

a.

|

$4,500,000

|

$3,000,000

|

$2,500,000

|

|

b.

|

$4,500,000

|

$3,000,000

|

$500,000

|

|

c.

|

$3,600,000

|

$2,400,000

|

$2,000,000

|

|

d.

|

None of the above.

|

|

|

A. Option c

B. Option a

C. Option d

D. Option b

13. Nanki Corporation purchased equipment on 1/1/09 for $650,000. In 2009 and 2010, Nanki depreciated the asset on a straight-line basis with an estimated useful life of 8 years and a $10,000 residual value. In 2011, due to changes in technology, Nanki revised the useful life to a total of six years with no residual value. What depreciation would Nanki record for the year 2011 on this equipment?

A. $650,000.

B. $122,500.

C. $108,333.

D. $106,667.

14. P. Chang & Co. exchanged land and $9,000 cash for equipment. The book value and the fair value of the land were $106,000 and $90,000, respectively.

Chang would record equipment at and record a gain/(loss) of

|

|

Equipment

|

Gain/Loss

|

|

a.

|

$99,000

|

$(16,000)

|

|

b.

|

$99,000

|

$(25,000)

|

|

c.

|

$108,000

|

$16,000

|

|

d.

|

$106,000

|

$(9,000)

|

A. Option b

B. Option c

C. Option d

D. Option a

15. On March 31, 2011, M. Belotti purchased the right to remove gravel from an old rock quarry. The gravel is to be sold as roadbed for highway construction. The cost of the quarry rights was $164,000, with estimated salable rock of 20,000 tons. During 2011, Belotti loaded and sold 4,000 tons of rock and estimated that 16,000 tons remained at December 31, 2011. At January 1, 2012, Belotti estimated that 20,000 tons still remained. During 2012, Belotti loaded and sold 8,000 tons.

Belotti would record depletion in 2012 of

A. $52,480.

B. $54,667.

C. $65,600.

D. $55,760.

18. Vijay, Inc., purchased a 3-acre tract of land for a building site for $320,000. On the land was a building with an appraised value of $120,000. The company demolished the old building at a cost of $12,000, but was able to sell scrap from the building for $1,500. The cost of title insurance was $900 and attorney fees for reviewing the contract was $500. Property taxes paid were $3,000, of which $250 covered the period subsequent to the purchase date. The capitalized cost of the land is

A. $201,150.

B. $336,150.

C. $334,650.

D. $336,400

16. Kingston Corporation has $95 million of goodwill on its books from the 2009 acquisition of Reliant Motors. At the end of its 2011 fiscal year, management has provided the following information for its annual goodwill impairment test ($ in millions):

|

Fair value of Reliant (approximates fair value less costs to sell)

|

$655

|

|

Fair value of Reliant's net assets (excluding goodwill)

|

600

|

|

Book value of Reliant's net assets (including goodwill)

|

700

|

|

Present value of estimated future cash flows

|

670

|

Assuming that Reliant is considered a reporting unit for U.S. GAAP and a cash-generating unit for IFRS, the amount of goodwill impairment loss that Kingston should recognize according to U.S. GAAP and IFRS, respectively, is

A. Option d

B. Option c

C. Option a

D. Option b

17. Bloomington Inc. exchanged land for equipment and $3,000 in cash. The book value and the fair value of the land were $104,000 and $90,000, respectively.

Bloomington would record equipment at and record a gain/(loss) of

|

|

Equipment

|

Gain/Loss

|

|

a.

|

$87,000

|

$3,000

|

|

b.

|

$104,000

|

$(5,000)

|

|

c.

|

$87,000

|

$(14,000)

|

|

d.

|

None of the above.

|

|

A. Option c

B. Option d

C. Option b

D. Option a

19. Fellingham Corporation purchased equipment on January 1, 2009, for $200,000. The company estimated the equipment would have a useful life of 10 years with a $20,000 residual value. Fellingham uses the straight-line depreciation method. Early in 2011, Fellingham reassessed the equipment's condition and determined that its total useful life would be only six years in total and that it would have no salvage value. How much would Fellingham report as depreciation on this equipment for 2011?

A. $27,333

B. $36,000

C. $24,000

D. $41,000

20. On June 1, 2010, the Crocus Company began construction of a new manufacturing plant. The plant was completed on October 31, 2011. Expenditures on the project were as follows ($ in millions):

|

Cash Outflow

|

Probability

|

|

|

July 1, 2010

|

54

|

|

|

October 1, 2010

|

22

|

|

|

February 1, 2011

|

30

|

|

|

April 1, 2011

|

21

|

|

|

September 1, 2011

|

20

|

|

|

October 1, 2011

|

6

|

|

July 1, 2010, Crocus obtained a $70 million construction loan with a 6% interest rate. The loan was outstanding through the end of October, 2011. The company's only other interest-bearing debt was a long-term note for $100 million with an interest rate of 8%. This note was outstanding during all of 2010 and 2011. The company's fiscal year-end is December 31.

In computing the capitalized interest for 2011, Crocus' average accumulated expenditures are

A. $124.25 million.

B. $46.30 million.

C. $122.30 million.

D. $103.54 million.

21. On June 1, 2010, the Crocus Company began construction of a new manufacturing plant. The plant was completed on October 31, 2011. Expenditures on the project were as follows ($ in millions):

|

Cash Outflow

|

Probability

|

|

|

July 1, 2010

|

54

|

|

|

October 1, 2010

|

22

|

|

|

February 1, 2011

|

30

|

|

|

April 1, 2011

|

21

|

|

|

September 1, 2011

|

20

|

|

|

October 1, 2011

|

6

|

|

July 1, 2010, Crocus obtained a $70 million construction loan with a 6% interest rate. The loan was outstanding through the end of October, 2011. The company's only other interest-bearing debt was a long-term note for $100 million with an interest rate of 8%. This note was outstanding during all of 2010 and 2011. The company's fiscal year-end is December 31.

What is the amount of interest that Crocus should capitalize in 2011, using the specific interest method (rounded to the nearest thousand dollars)?

A. $7,248,000 (rounded)

B. None of these answers is correct.

C. $8,740,000 (rounded)

D. $7,283,000 (rounded)

22. Below are data relative to an exchange of similar assets by Grand Forks Corp. Assume the exchange has commercial substance.

In Case A, Grand Forks would record the new equipment at

A. $60,000.

B. $50,000.

C. $65,000.

D. $75,000.

23. Fryer, Inc., owns equipment for which it paid $90 million. At the end of 2011, it had accumulated depreciation on the equipment of $27 million. Due to adverse economic conditions, Fryer's management determined that it should assess whether an impairment should be recognized for the equipment. The estimated undiscounted future cash flows to be provided by the equipment total $60 million, and the equipment's fair value at that point is $40 million. Under these circumstances, Fryer would record

A. an impairment loss on the equipment of less than $1,000.

B. a $3 million impairment loss on the equipment.

C. no impairment loss on the equipment.

D. a $23 million impairment loss on the equipment.

24. Horton Stores exchanged land and cash of $5,000 for similar land. The book value and the fair value of the land were $90,000 and $100,000, respectively.

Assuming that the exchange has commercial substance, Horton would record land-new at and record a gain/(loss) of

|

|

Land

|

Gain/Loss

|

|

a.

|

$105,000

|

$ 0

|

|

b.

|

$105,000

|

$10,000

|

|

c.

|

$95,000

|

$ 0

|

|

d.

|

$95,000

|

$10,000

|

A. Option d

B. Option b

C. Option c

D. Option a

25. Asset C3PO has a depreciable base of $16.5 million and a service life of 10 years. What would the accumulated depreciation be at the end of year five under the sum-of-the-years' digits method?

A. $4.5 million.

B. $12 million.

C. $8.25 million.

D. $16.5 million.