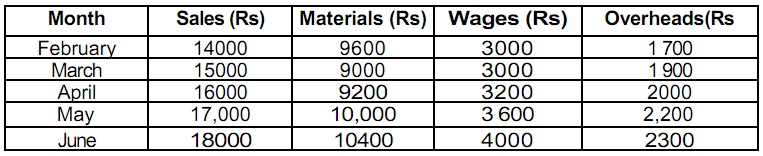

Question 1: You are provided with the given information relating to the Rooney PLC. The accountant is presently making the budget for the next three months ending 30 June 2010.

a) The credit terms are as shown: 10% sales are cash, 50% of the credit sales are collected next month and the balance in the given month.

b) For the given items of expenditure, the credit terms are as shown:

Materials – 2 months, Wages – 1 month, Overheads – 1 month.

c) Cash and bank balance on 1st April 2010 is expected to be Rs 6000

d) Other relevant information:

i) Plant and Machinery will be installed in February 2010 at a cost of Rs 96, 000. The monthly installments of Rs 2000 is payable as from April onwards.

ii) The dividend of 5% on the ordinary share capital of Rs 200 000 will be paid on 1st June.

iii) The advance receipt of Rs 9000 is expected in June and will associate to the sale of vehicles.

iv) Dividends from investments amounting to Rs 1000 are to be received in May.

v) The advance payment of income tax is to be paid in June of Rs 2000.

Required:

Make cash budget for 3 months ending 30 June 2010.

Question 2: As cash is very essential for the survival of any business, it is often recommended to make a cash budget, as it is no use budgeting for product ion and for sales if, throughout the budget period, the business runs out of cash funds.

Required: Explain four benefits why cash budgets must be made?