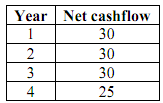

The multinational Khazad-dum Inc. has purchased The Erebor Mining Company for 100 million gold coins. The Erebor Mining Company owns a single mine which is expected to generate the following net cashflows:

Assume that the mine closes at the end of the fourth year, and that nether mining company has to face any other kind of costs for the exploitation of the mine.

a) At the moment of the purchase, the interest rate on gold coins was 5%. Was this purchase a good deal for Khazad-dûm Inc.?

b) Shortly after the transaction, the interest rate increases to 7% for external reasons unrelated to the transaction. Does that affect your answer in (a)?

c) Based on your answer to questions (a) and (b), why might the managers of The Erebor Mining Company have accepted the offer of 100 million gold coins?