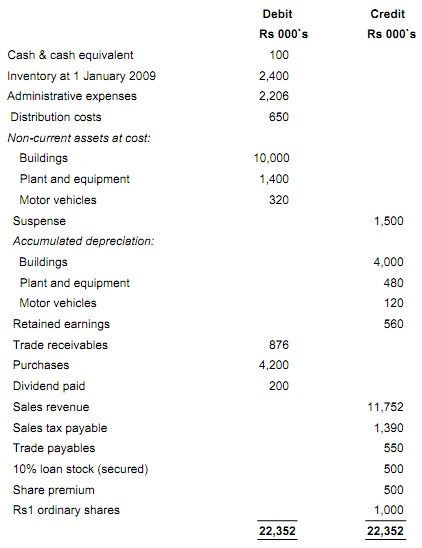

You are the assistant financial controller of Pride Ltd. The company`s year end is 31 December 2009. The given balances were extracted as at 31 December 2009.

The given additional information is relevant.

a) Inventory at 31 December 2009 was valued at Rs1, 600,000. While doing the inventory count, errors in the preceding year's inventory count were discovered. The inventory brought forward at the starting of the year must have been Rs 2.2m, not Rs 2.4m as above.

b) Depreciation is to be given as follows:

i) Buildings at 5% straight line, charged to administrative expenses.

ii) Plant and equipment at 20% on the decreasing balance basis, charged to the cost of sales.

iii) Motor vehicles at 25% on the decreasing balance basis, charged to distribution costs.

c) No final dividend is being proposed.

d) A customer has gone bankrupt owing Rs 76, 000. This debt is not expected to be recovered and an adjustment must be made. An allowance for receivables of 5% is to be set up.

e) 1 million new ordinary shares were issued at Rs1.50 on 1 December 2009. The proceeds have been left in a suspense account.

Required:

Question 1: In accordance with the needs of the International Accounting Standards (IAS 1), prepare, for the year ended 31 December 2009:

a) A Statement of the Financial Performance.

b) A Statement of the Financial Position.

c) A Statement of changes in equity.

Question 2: In brief describe any three of the given accounting concepts:

a) Going concern

b) Accruals/Matching

c) Materiality and aggregation

d) Consistency of presentation

e) Offsetting