Problem:

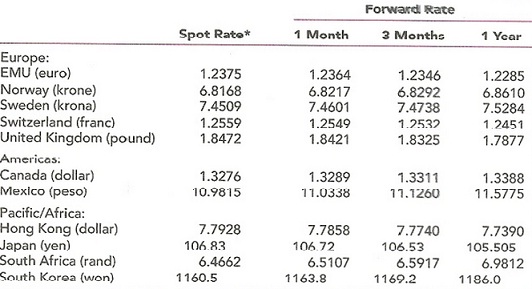

The table above shows the 90-day forward rate on the South African rand.

1. Is the dollar at the forward discount or premium on rand?

2. What is annual percentage discount or premium?

3. If you’ve no other information regarding the two currencies, what is your best presumption about the spot rate on the rand three (3) months hence?

4. Assume that you expect to get 100,000 rand in 3months. How many dollars is this likely to be worth?