Question 1: Explain the construction of profit and loss a/c.

Question 2: Describe in detail regarding accounting concepts and functions.

Question 3: Describe the auditor’s penalty for non-compliance.

Question 4: Describe the relationship among the cost-sales and profit.

Question 5: Explain the accounting procedure for declaring and distributing the dividends.

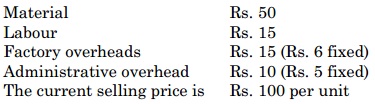

Question 6: An organization is presently running at 50% capacity and produces 5,000 units at a cost Rs. 90 per unit as per detail shown below:

At 60% working, material cost per unit rises by 2% and selling price per unit drops by 2%.

At 80% working, material cost per unit rises by 5% and selling price per unit drops by 5%.

Estimate the profits of the factory at 60% and 80% working and give your comments.

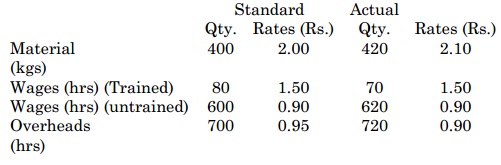

Question 6: Compute the variances in the given cases.