Accounting Errors—Transaction Errors

How would the following errors affect the account balances and the basic accounting equation, Assess = Liabilities t Ownen'Equiv? How do the misstatements affect income?

a. The purchase of a truck is recorded as an expense instead of an asset.

b. A cash payment on accounts receivable is received but not recorded.

c. Fictitious sales on account are recorded.

d. A clerk misreads a handwritten invoice for repairs and records it as $1,500 instead of $1,800.

e. Payment is received on December 31 for the next three months' rent and is recorded as revenue.

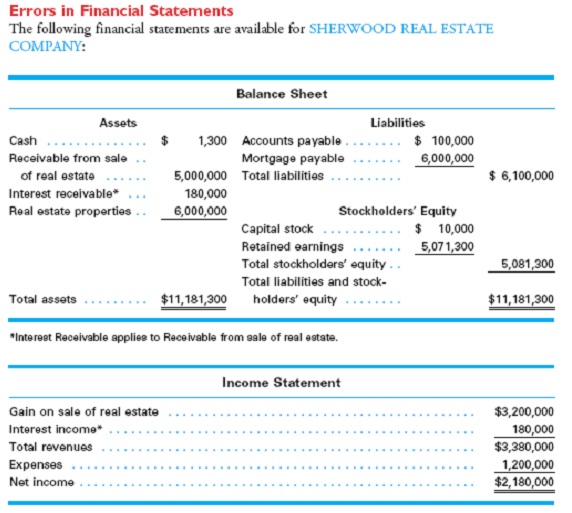

Sherwood Company is using these financial statements to entice investors to buy stock in the company. However, a recent FBI investigation revealed that the sale of real estate was a fabricated transaction with a fictitious company that was recorded to make the financial state-ments look better. The sales price was $5,000,000 with a zero cash down payment and a $5,000,000 receivable. Prepare financial statements for Sherwood Company showing what its total assets, liabilities, stockholder' equity, and income really are with the sale of real estate removed.